Key takes

XRP increased 10 % on the first trading date of 2025 to $ 2.3. XRP has dominated the transaction volume than Korean bitcoin and Ethereum.

Please share this article

According to COINGECKO’s data, XRP has risen 10 % in the past 24 hours, recovering the last $ 2.3 mark on December 26, starting the New Year with powerful performance.

This rally comes when most of the major encryption assets remain relatively flat. Bitcoin is currently trading about $ 94,000 with a minimum, but other major encryption assets such as Ethereum, Binance Coin, and Solana have hardly shown price actions.

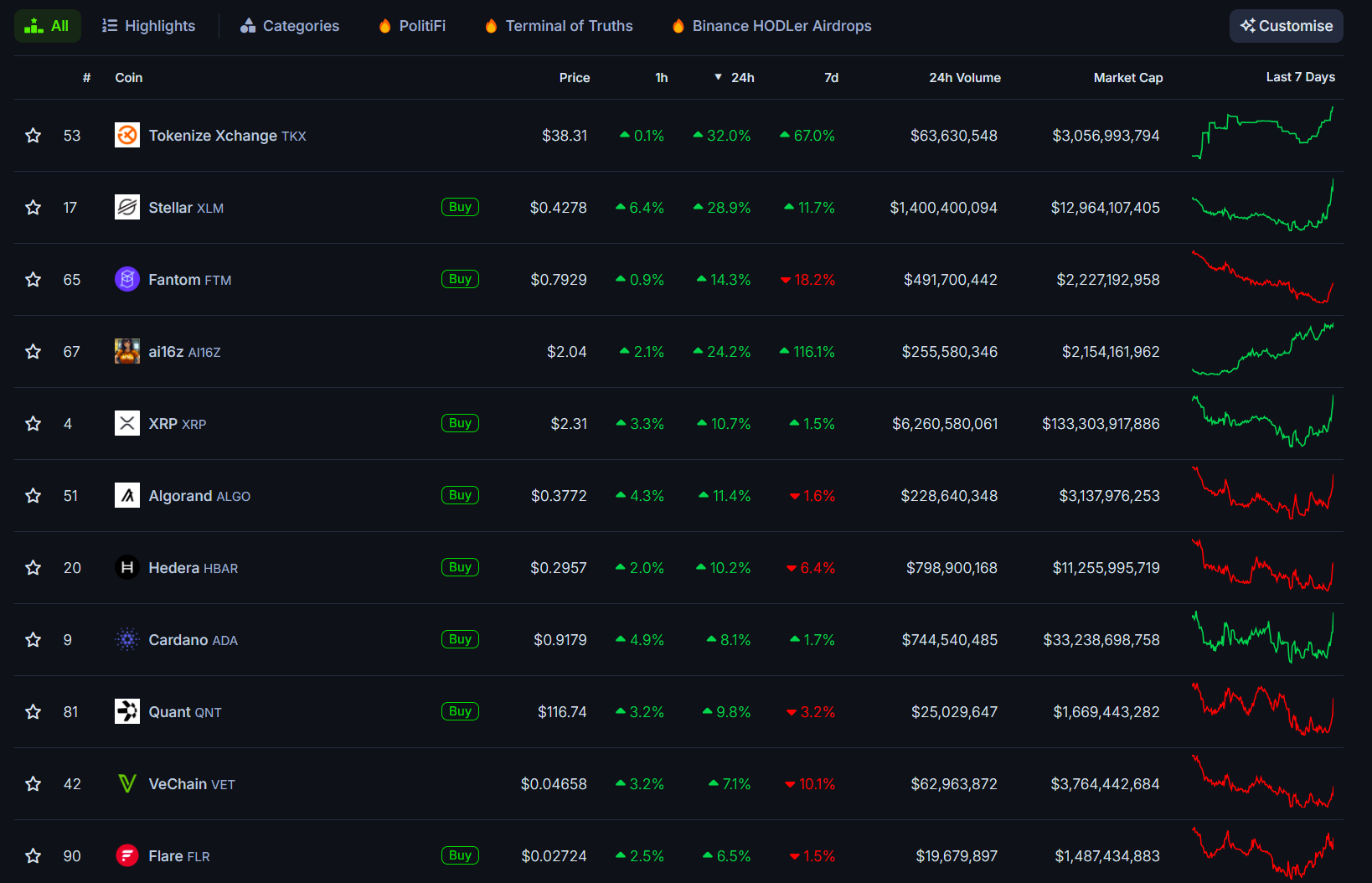

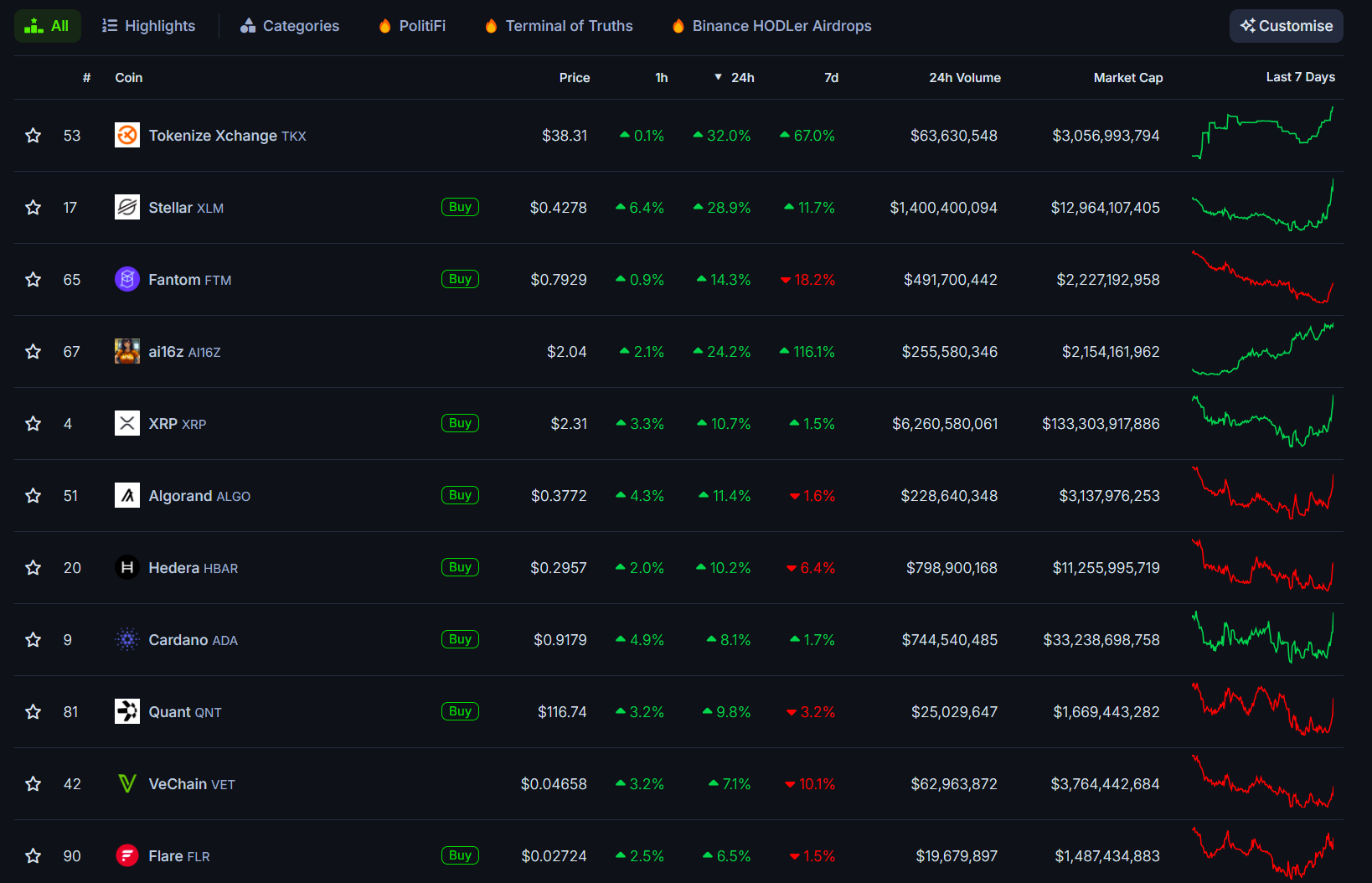

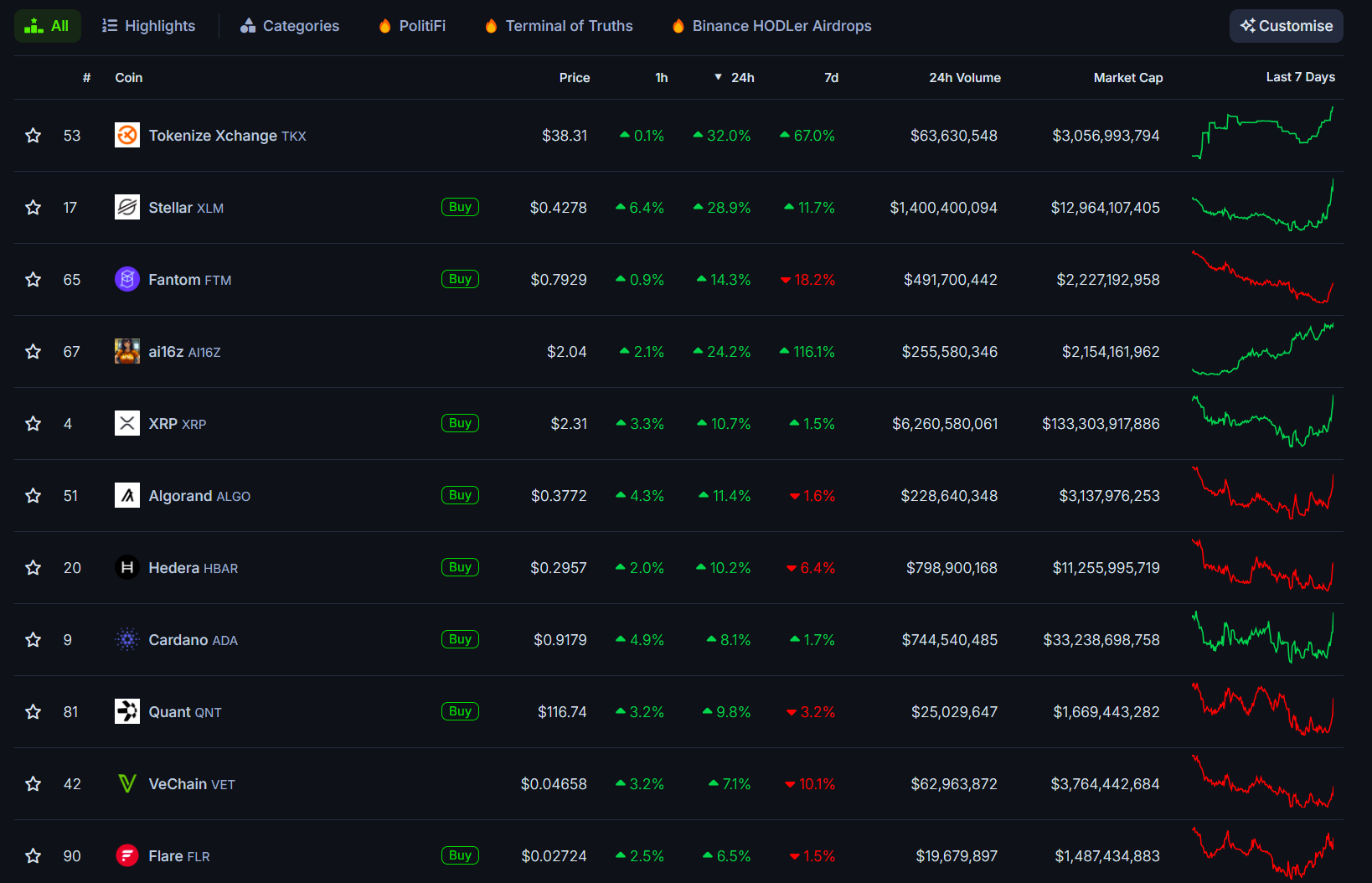

In contrast, AltCoins, which include XCHANGE (TKX), Stellar (XLM), Fantom (FTM), and Algorand (Algo), tokenization XCHANGE (TKX), Stellar (XLM), and Fantom (FTM), are established. In the past 24 hours, we have recorded two -digit profits. The major cipher assets with market capitalization, such as Hedera (Hbar) and Cardano (ADA), are also increasing significantly.

Recently, the AI16Z token, which became the first AI coin in the Solana blockchain, has expanded its profits due to the total market capitalization of $ 2 billion. Currently, tokens, which are trading for more than $ 2, have risen 21 % in the past 24 hours, and are located on the highest percentage of each day.

Surse of XRP transactions in Korea

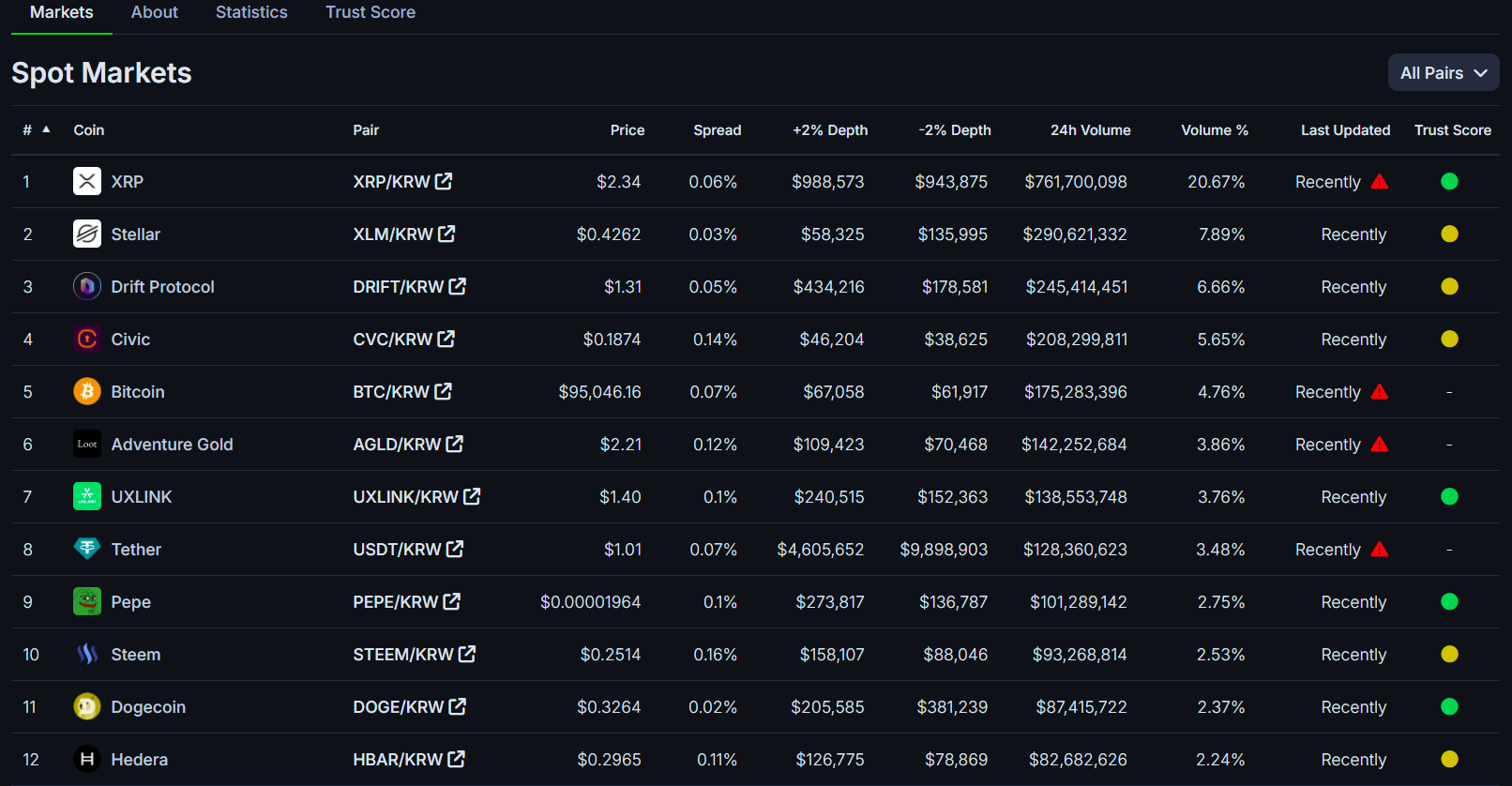

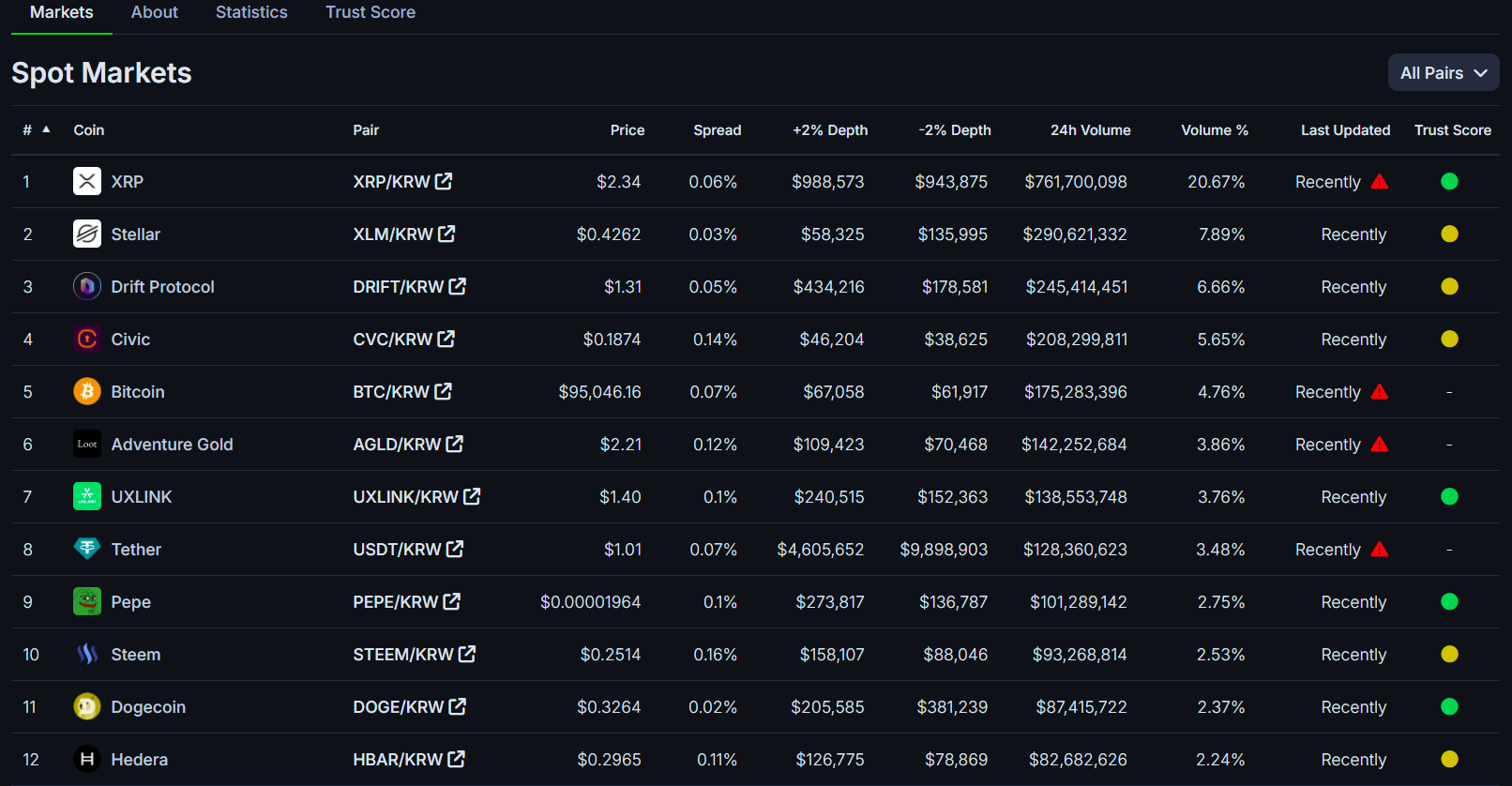

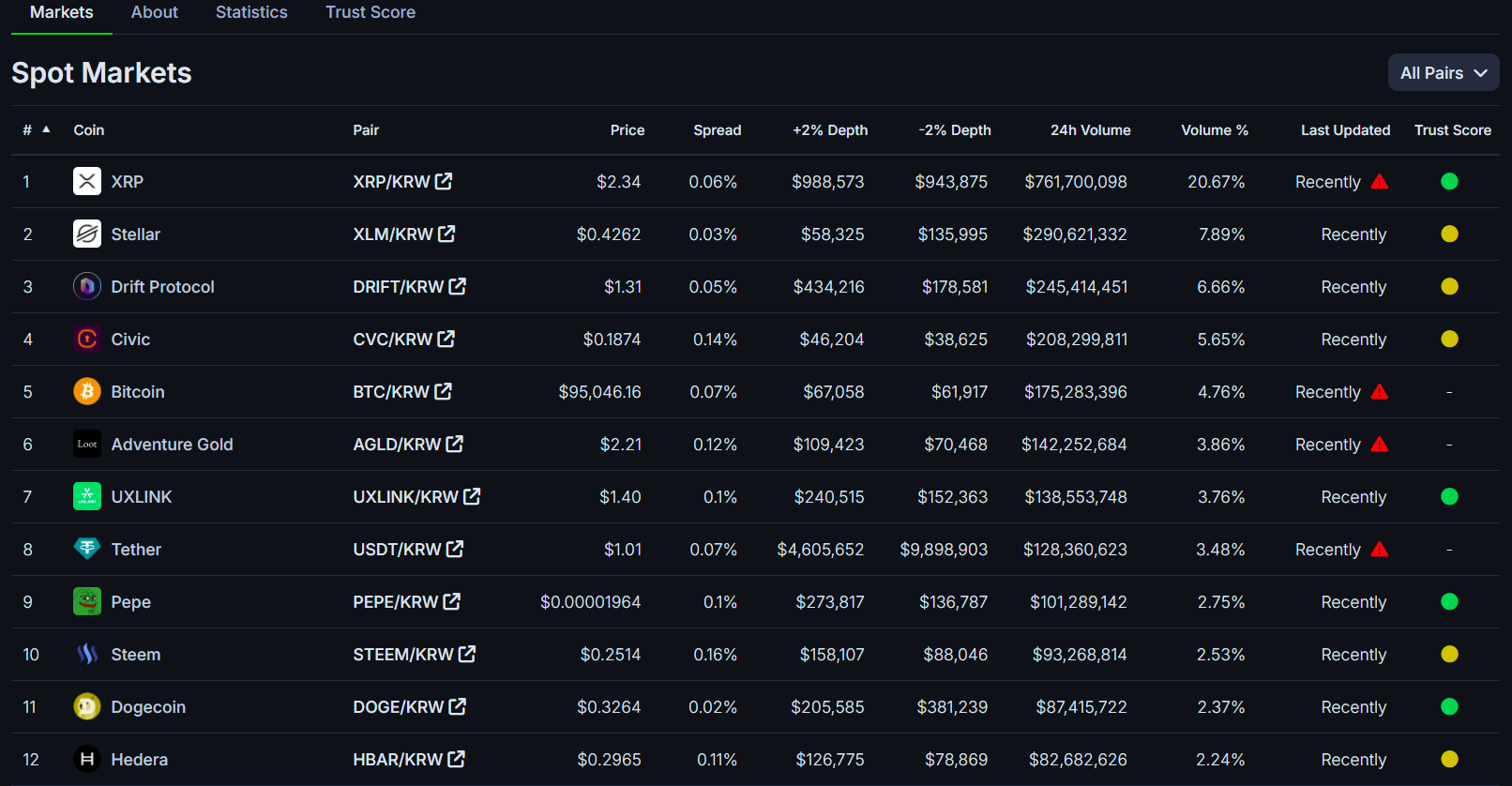

In Korea, XRP transactions are more than Bitcoin and Ethereum for major exchanges nationwide.

The total amount of transactions to WON in Upbit, Bithumb, and KORBIT exceeded $ 1 billion in the past 24 hours, XRP recorded $ 254 million on BITHUMB and $ 761 million in UPBIT.

It has been suggested that a large amount of transactions increases the market interest in assets and is actively buying and selling many investors.

Changes in transactions can show a potential trend reversal or continuation. Large -orders can affect prices, so large transactions can improve market volatility.

The volume surge has occurred in the political development of Korea, and the court issued an arrest warrant to President Yunsokyor on Tuesday over his December martial law.

The inauguration ceremony of Trump, the resignation of SEC Chair for 2 weeks or more

Trump’s inauguration ceremony as the 47th president of the United States is scheduled for January 20. On that day, SEC Chair Gary Genler resigns.

The arrival of Trump and the departure of Gensler are expected to open a way to change the regulatory approach to encrypted sectors that have long been hostile under the current administration.

For the Ripple Community, these events could end the one -year legal battle between Ripple and US Securities Watchdogs, and could potentially bring any litigation reconciliation or dismissal. It is anticipated that the legal status of XRP will be clarified and the SEC will create a precedent for other cipher assets classified as securities.

Furthermore, as the US regulatory environment has mature, it means guidance and clarity, one or more spot XRP ETFs will secure the approval of regulatory authorities along with other cipher ETF waves.

As of January 1, some fund managers, including Bitwise, Canary capital, 21 share, and Wisdomtree, are lined up for approval to launch each XRP ETF.

The development of the XRP ETF progress or the SEC-Ripple case is expected to greatly affect the price movement of XRP.

Please share this article