By Omkar Godbole (unless otherwise indicated)

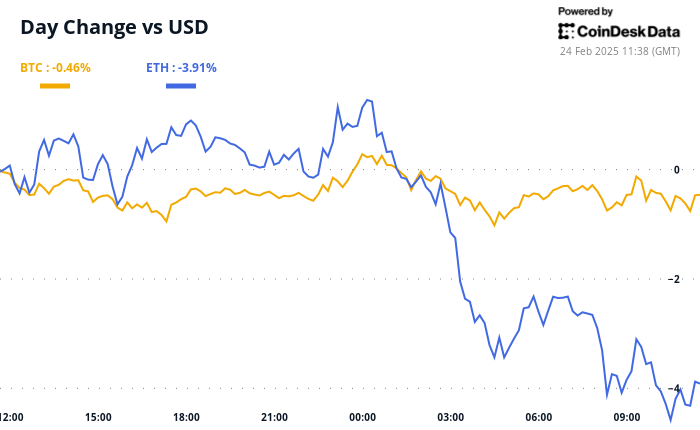

Two biggest digital assets by market value, Bitcoin and Ether, remain within the scope of recent trading, two days after the $1.5 billion buybit hack, is one of the most recent cryptocurrency exchanges.

Both persistent funding rates are positive, indicating a bias for long positions that benefit from price increases. Bitcoin options trading at Deribit shows a bullish bias in call options across all time frames, while those tied to ether show a negative side bias in March. However, etheric bias has been around for quite some time before the hack.

Meanwhile, Volmex Finance’s 30-day Bitcoin implicit volatility index fell to a lowest since July 48.45%, according to charting platform TradingView. The implicit volatility of the ether reversed the minor weekend spike from 67% to 70%.

According to QCP Capital, mildness is a sign of market maturity. “Price measures highlight the maturity of the crypto landscape, particularly in the crypto credit market, since the FTX collapse in 2022,” the trading company said. “From custody and security solutions to corporate governance and transparency, every aspect of crypto has been strengthened with each past crisis.”

Overall, the Crypto community is relieved by BYBit’s ability to manage more than $6 billion withdrawals after the hack. Additionally, the exchange filled the gap in its ETH reserve.

All eyes are in Sol in Solana as Franklin Templeton, one of the world’s largest asset management companies, submitted a proposal for the Sol Sol ETF to Sec, according to Mena Theodorou, co-founder of Crypto Exchange Coinstash. Additionally, 11.2 million SOL (2.3% of total supply) from FTX Estate is scheduled to be unlocked on March 1, potentially breeding market volatility. This already pushes up the volume of Deribit’s Sol Put Options.

President Donald Trump’s decision to audit gold reserves in Fort Knox, Kentucky, intrigued the crypto community. “Daily gold audits are rare, but the timing is noteworthy as Trump continues to push the Procrypt story. If gold supply turns out to be lower than expected, then the Bitcoin case is It could be strengthened as digital gold. Protected assets,” Theodow said in an email.

In traditional markets, the yen continues to hold ground for US dollars, such as the Australian dollars, and growth-sensitive commodity currencies, calling for attention on the part of Risk Asset Bulls. Leave a warning

What to see

Cryptography: Macrofeb. 24, 8:00 PM: The Bank of Korea (BOK) Monetary Policy Committee announces its interest rate decision. 2.75% vs. 3% February. 25, 10:00 AM: The Conference Committee (CB) will release its February Consumer Trust Index report. CB Consumer Trust EST. 102.1 vs. 104.1feb. 25, 1:00 PM: Richmond Federal President Tom Birkin gives a speech entitled “Inflation and Now.” February. 25, 7:30 PM: Australian Bureau of Statistics releases its January “Monthly Consumer Price Index Indicator” report. 2.5% vs. 2.5% revenue 24: Riot Platforms (Riot), Post-Market, $ -0.18Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $ -0.17FEB. 25: Crypto Mining (CIFR), pre-market, $-0.09Feb. 26: Mara Holdings (Mara), Post Market, $ -0.13feb. 26: Nvidia (NVDA), Post Market

Token Event

Governance vote and Cole Ske Dao cut the liquidity owned by the Smart Burn Engine protocol to $15 million, adjusting parameters that allow for immediate buyback, and directing all surplus towards burning. Voting for important changes. To improve the adaptability of the system, the mint fee of 0.5% and Flash Redeem Fee are 5%. DAO has discussed the establishment of the dydx repurchase program. That first step is to buy back token.unlocksfeb, allocating 25% of DYDX’s protocol net revenue. 28: Optimism (OP) unlocking 2.32% of distribution supply worth $35.43 million. 1: dydx unlocked 1.14% of its circulation supply worth $6.24 million. 1: Zeta Chine (Zeta) unlocks 6.48% of the circulation supply worth $13.7 million. 1: Sui (Sui) unlocks 0.74% of the circulation supply worth $81.07 million. 7: Kaspa (KAS) unlocks 0.63% of the circulation supply worth $15.55 million. 12: Aptos (APT) unlocks 1.93% of its distribution supply worth $69.89 million. 25: The Zoo (Zoo) is listed on Kucoin.feb. 26: Moonwell (well) listed on kraken.feb. 27: Venice (VVV) listed on Kraken.feb. 28: WorldCoin (WLD) listed in Kraken.

meeting:

The Koindsk consensus will be held in Toronto from May 14th to 16th. Save 15% on your pass with Code Day Book.

Token talk

By Francisco Rodriguez

The perpetrators of the nearly $1.5 billion hack of the $1.5 billion major Crypto Exchange By Bit appear to be turning their eyes to the popular Solana-based token launchpad pump. (s) After 60 Sol Transfers, after removing the token from the front end to prevent this type of activity, it may launch immediately into a popular decentralized exchange radium based in Solana The blow-in automated market maker (AMM) benefited from being a platform graduation pump.

Positioning of derivatives

Sol Put Options expired on DeLibit Trade with a 7 vol points premium this Friday, reflecting the fear of its strong flaws. The ether option continues to show concerns about negative side risk until the end of March, with subsequent expiration dates reflecting bullish positioning. The BTC option is biased and bullish throughout the time frame. BTC block flows in DERIBIT feature the spread of calendar spreads and bull call. The ETH flow included long positions in calls on the $2,850 and $2,900 strike, along with short tensions in April’s satisfaction. The funding rate for permanent futures linked to OM tokens remains negative. This is a sign of traders making protective bear bets as spot prices continue to hit record highs.

Market movements:

BTC rose 0.7% from 4pm on Friday, $95,581.78 (24 hours: -0.6%) ETH increased 1.91% to 2,679.37 (24 hours: -4.25%) Coindesk 20 increased 3,089.09 (24 hours: -3.52%) ) has increased by 1.18%. The combined staking rate has not changed, with 2.99% BTC funding rate of 0.0069% (7.51% per year), BinancedXy has not changed at 106.6.6gold. 23,341.61ftse is an increase of 0.1% at 8,668.07. -1.44%25,147.03S&P 40 40 Latin America has risen at 1 bp at 2,408.55 US -2.89% at 2,408.55 US by 10 years at 2,408.55 US. %21,761.75E-MINI DOW JONES INDUSTRIAL ARAGEM INDEX futures are up 0.71% at 43,796.00

Bitcoin statistics:

BTC domination: 61.65% (24 hours: 1.3%) Ethereum to Bitcoin ratio: 0.02801 (-4.4%) Hashrate (7-day moving average): 789 EH/SHASHPRICE (SPOT): $56.53-TOTAL Fee: 5.65 BTC/$540,507CME Futures Open Open Open Open Interest: 169,620 BTCBTC Price Gold: 32.3 OZBTC vs. Gold Market Cap: 9.17%

Technical Analysis

Sol’s daily chart shows that cryptocurrencies fell below the critical 200-day simple moving average. Furthermore, we checked the breakdown of the double top with movement below the horizontal (yellow) support line. The bearish technology setup suggests a range of ongoing losses to $120, which served as the floor last year. A move above the $209 lower high printed earlier this month would negate the bearish technical outlook.

Crypto stocks

MicroStrategy (MSTR): Closed on Friday at $299.69 (-7.48%), up 1.21%, up 1.21%, and increased by $303.31 at MarketCoinbase Pre-Marketcoinbase Global (Coin). glxy): 22.76 c $22.76 (-11.27%) closed at Mara Holdings (Mara): 14.66 (-8.09%) closed at 0.41% increase 14.72 Riot Platform (riot): 10.46 (-9.83%) closed at 10.75 Core Science (CORZ) increased by 2.77%: $10.80 (-8.788 (-8.788)%), not changed in Pre-Marketcleans Park (CLSK): $9.24 (-8.15%), 0.97 %$ 9.34COINSHARES VALKYRIE BITCOIN MINERS ETF (WGMI): 20.52 (-8.76%) Closed with Semler Scientific (SMLR): 47.74 (-8.61%), 0.65% Closed with $47.74 (-8.61%) (Exod): Closed with $47.81 (+0.02%) )

ETF Flow

Spot BTCETFS:

Daily Net Flow: Cumulative Net Flow: $69.2 million: BTC holdings of $39.57 billion – 1167 million.

Spot ETH ETF

Daily Net Flow: Cumulative Net Flow: $8.9 million in ETH Holdings – $3.15 billion ~3.808 million.

Source: Farside Investors

One night flow

The chart of the day

Daily and cumulative trading volumes on Solana’s decentralized exchanges have declined significantly since Trump Memecoin’s debut a month ago.

While you’re asleep

Bibit closes “ETH gap” as exchanges replenish $1.4 billion in holes after a hack (Coindesk): LookonChain Bybit on-chain tracking service will be loans, bulk deposits and ether over the past two days I received about 446,870 ETH via purchase. Playing with DeRibit in Sol Meltdown and Premending Unrock (Coindesk): Slow drop in Sol Price, Decline, Solana Network Activity from the decline of MemeCoin and massive token unlocking drives a surge in Sol Put Options It’s there. The ECB may have to lower key rates for levels that stimulate the economy, Wunsch says (Financial Times): Pierre Wunsch, governor of the Belgian National Bank, says that eurozone inflation is cold If demand is weak, the ECB’s key rate could drop to 2%, with 20255.options traders lined up. Hedges before the pivotal Nvidia revenue (Bloomberg): Despite the S&P 500 rally, traders are enduring volatility, and the surge in VIX call activity has brought attention. Trump passes Russia’s economy to lifeline after three years of war (Reuters): Russia’s sustained inflation and 21% interest rates stem from the war in Ukraine, causing the ruble to take up six months This has been partially eased by the promotion of a peace agreement that has been increased to. Dollar.Singapore’s high on inflation rises at its slowest rate since February 2021 (CNBC): In January, Singapore’s headline inflation rises 1.2% year-on-year, economists voted by Reuters are expected This is below 2.15%. Core inflation fell to 0.8%.

With ether