Keynote

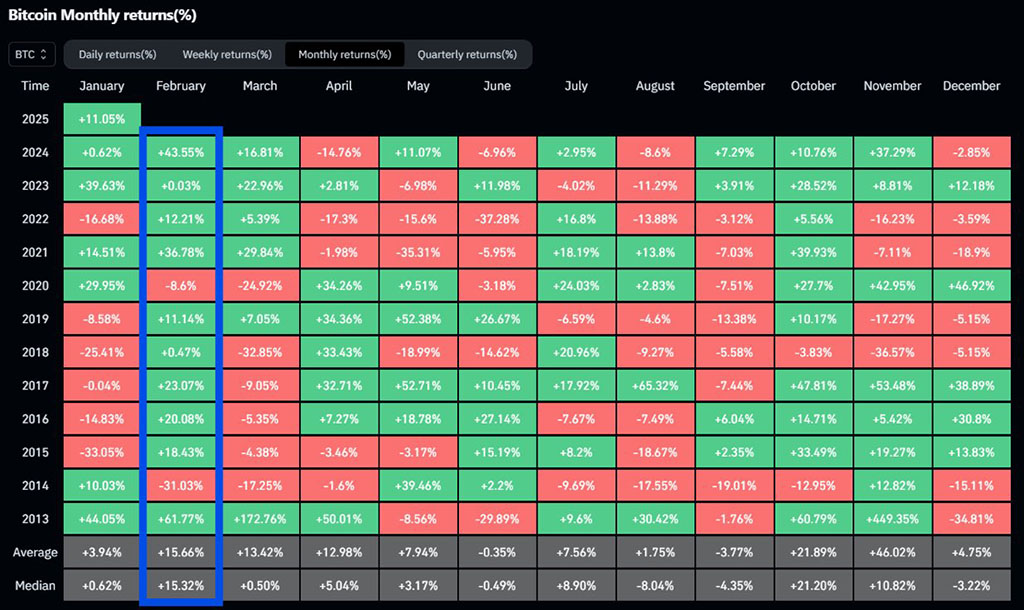

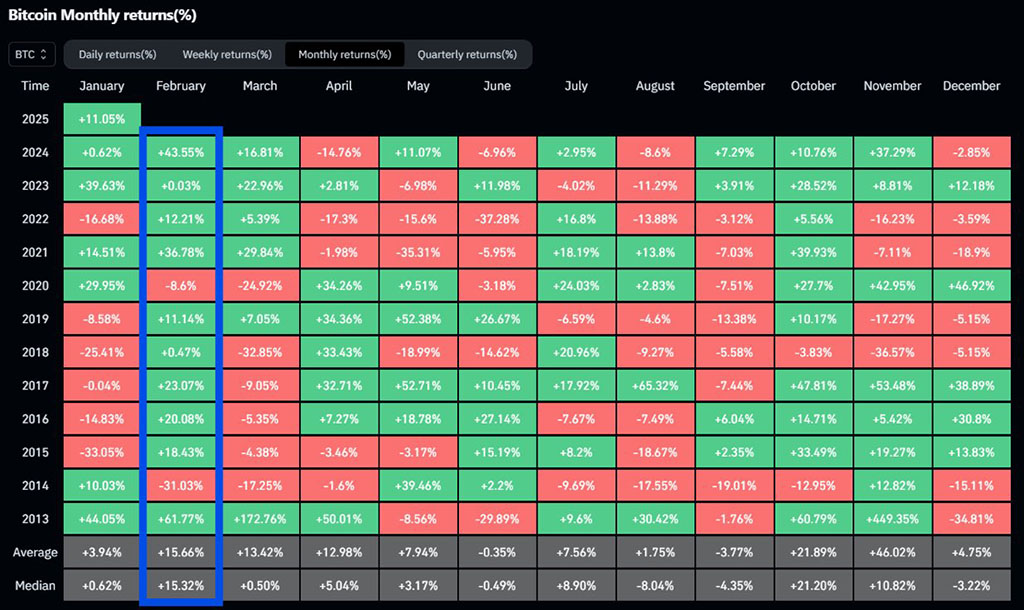

Bitcoin has put up resistance at $104,250, but analysts like Michael Van de Poppe are hoping to have a breakout within a week or two. If Bitcoin regains $106,000, it can lose $98,000, but the history of $89,500.february could cause +15.66% gains. In 2024, we have already streamed +43.55% of the meetings.

Bitcoin

BTC

$84 667

24-hour volatility:

0.6%

Market Cap:

$1.68 t

Vol. 24H:

$8.09 b

We achieved a critical level of resistance at $104,250, but were unable to break through and temporarily stopped our upward momentum. Analysts see this as a momentary integration rather than a reversal, with many still predicting the new all-time high (ATH) in February. Crypto analyst Michael Van de Poppe believes a breakout could occur within the next week to two weeks, potentially making it a stage-setting.

Source: Michael Van de Poppe

Despite the short-term pullback, Bitcoin continues to show bullish strength, with its key support zone stabilising at $99,993. The market structure suggests a higher formation, making between $96,000 and $98,000 the ideal entry zone for traders. Once Bitcoin regains $106,000, analysts expect an upward push towards the $112,000-$115,000 level.

With stable trading volumes, the market momentum remains strong, suggesting accumulation at current levels. A breakout of over $106,000 could trigger a rapid rally to $120,000, bolstering another record-breaking expectation in February. However, losing $98,000 in support could result in a deeper pullback, possibly testing a lower level of $91,500-89,500.

Ten of the last February 12th remained bullish. Will history repeat itself?

Crypto analyst Mojoe hinted at Bitcoin’s strong historic track record in February. Over the years, February has produced an average return of +15.66% and a median return of +15.32%. The outstanding year includes a massive 36.78% profit for 2021 and an even more impressive 61.77% rally in 2013. But not all February is bullish. In 2020 there was an 8.6% decline, and in 2014 it recorded a steep slope of 31.03%.

Source: Mojoe

The bullish trend continued into 2024, offering an incredible +43.55% gain, making it one of Bitcoin’s best February performances. Given the strong rally trends in Bitcoin early years, many analysts believe that digital assets can once again follow that historical pattern.

Bitcoin remains stable in the middle of its current range, urging analysts to dismiss concerns. Crypto Trader Pentoshi, followed by 749,200 users on X, highlighted Bitcoin’s resilience amid the weakness of the broader market, and interpreted it as a strong bull signal. Supporting the optimistic outlook, analyst Mitch pointed to market conditions that could lead to a major upward movement.

“If there’s certainly something possible given the similar movement, the current market situation, Bitcoin could reach a new all-time high of around $119,000 by February 5th!” Mitch said.

Michael Van de Poppe had previously strengthened his bullish perspective, but after the Federal Open Market Committee (FOMC) meeting, he noted that Bitcoin’s position was $104,000. A breakout above $105,000 could set the stage for record highs in February.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information, but should not be considered financial or investment advice. Market conditions can change quickly, so we recommend that you review your information yourself and consult with an expert before making a decision based on this content.

With over three years of cryptowriting experience, Bena strives to make crypto, blockchain, Web3 and fintech accessible to everyone. Beyond cryptocurrency, Bena also enjoys reading books in her spare time.

Bena Ilyas of x

Julia Sakovic of x