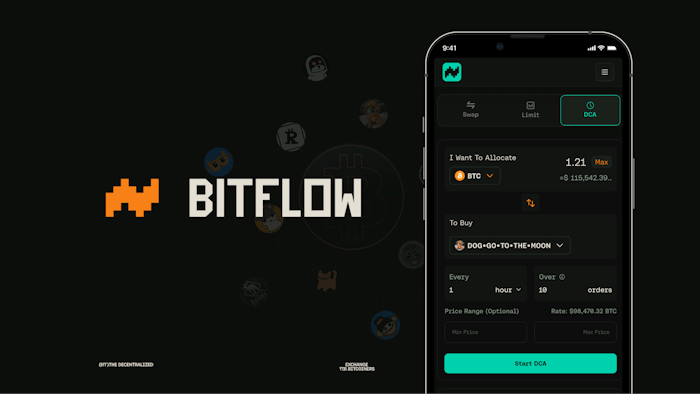

Bitflow launches an automated Dollar Cost Average (DCA) for stack Bitcoin and Rune investments. Electrically-equipped DCAs enable unreliable, repetitive investments. Future plans include adding yield strategies and cross-layer flows.

Bitflow, a decentralized exchange built on the Stacks Ecosystem, has announced an automated dollar cost average (DCA), a groundbreaking feature that introduces AI-driven investment strategies to Bitcoin and its associated assets. did.

Automated DCA allows users to automate repeat purchases of popular Runes tokens like Bitcoin (BTC), Stablecoins, Stacks native STX tokens, SBTC, and $Dog.

Bitflow’s latest offerings mark a key milestone in distributed finance (DEFI) over Stacks Layer 2 networks, with Bitflow’s latest offerings.

Simplify Bitcoin debt investment through automation

At the heart of automated dollar cost averaging (DCA) is Bitflow Keepers, an intelligent automation engine powered by DCA features. This technology allows users to time the market and allow unreliable, repetitive transactions without having to manually execute transactions.

By supporting a wide range of assets, including SIP-10 tokens and MemeCoin Sensation $DOG (DOG)), Bitflow allows users to seamlessly diversify their portfolios.

Stack’s Defi enthusiasts can program their investment strategies for the first time, converting Bitcoin into dynamic yield generation assets.

In particular, Bitflow’s non-mandatory design ensures that transactions remain fully on-chain, eliminating reliance on third-party intermediaries while providing transparency and security.

Bitflow co-founder and lead developer Dylan Floyd highlights the potential for change in this feature, and Bitcoin Defi enters a new era of automation, allowing users to leverage advanced tools to make ownership more efficient It was pointed out that it can grow to.

In particular, automated DCA capabilities are the first step in the roadmap aimed at integrating AI-driven automation into DEFI. Future enhancements include automated agriculture strategies to enable users to optimize returns for BTC-based assets without constant monitoring.

Market-triggered swap plans are also being implemented. This allows traders to set conditions for performing transactions based on price movements and volatility, and add a refined layer to their Bitcoin trading.

Additionally, Bitflow plans to improve liquidity by encouraging seamless asset transfers between Layer 1 of Bitcoin and Layer 2 of Stacks, filling the gap between the two ecosystems.

This ambitious agenda highlights Bitflow’s role as a pioneer of the Stacks Ecosystem, serving as a liquidity hub for trading Bitcoin assets.

By incorporating Runes and SIP-10 tokens into decentralized exchanges, Bitflow expands the scope of Bitcoin native finance, appealing to both veteran traders and newcomers looking for an efficient way to engage with the market. It’s there.