Cboe has filed a 19B-4 filing allowing Spot Ethereum ETF to list and trade options. This proposal follows high demand for Ethereum ETFs. NYSE American has made similar proposals, although it has not yet been approved by the SEC.

CBOE BZX Exchange has officially filed its 19B-4 filing with the US Securities and Exchange Commission (SEC) seeking approval of the Spot Ethereum Exchange Trade Fund (ETF) listing and trading options.

The move marks a crucial step for CBOE to expand investor access to Ethereum, reflecting the growing demand within the cryptocurrency market.

CBOE aims to expand its investment tools

The CBOE proposal aims to expand the many investment tools available to market participants. By allowing options trading on Ethereum ETFs, investors gain an accessible means of engaging in Ethereum price movements.

The 19B-4 filing includes funds managed by Bitwise and Grayscale, particularly funds such as the Grayscale Ethereum Trust and the Grayscale Ethereum Mini Trust.

Exchanges assume that these options serve not only as alternative means for investors to be exposed to Ethereum, but also as important hedging devices against the inherent volatility of the cryptocurrency market.

In particular, the filling of the CBOE follows a similar proposal by NYSE American. This is not yet SEC approved. Regulators cite concerns about market manipulation, investor protection and ensuring a fair trading environment.

The SEC’s reluctance is rooted in Section 6(b)(5) of the Securities and Exchange Act 1934, highlighting the protection of investors and the maintenance of a fair and orderly market.

Despite these challenges, Cboe’s proposal is surrounded as a competitive response to the NYSE initiative, suggesting the market’s potential enthusiasm to see these financial products come to fruition .

CBOE’s approach in filing emphasizes that Ethereum ETF options are governed by the same strict rules as other fund sharing options on the platform, such as list requirements, margin rules, and trading terminations. This regulation integrity is intended to reassure the SEC of compliance with proposals against existing frameworks, as well as those applied to Bitcoin ETF options approved under similar regulatory scrutiny. .

Ethereum ETFS investors’ interest surges

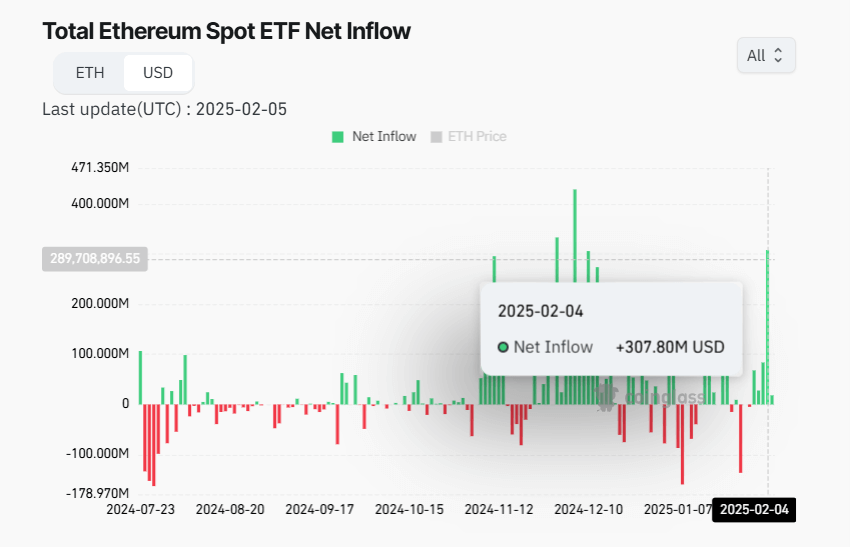

The timing of the CBOE filing coincides with a surge in investor interest in Ethereum ETFs. Recently, these funds have seen unprecedented trading volume and net inflows.

For example, on February 4, 2025, Ethereum ETFS recorded a net inflow of $377.7 million.

This performance not only supports the rationale behind the introduction of options trading, but also highlights the market’s preparation for such financial innovation.

The introduction of options to Ethereum ETFs could stabilize Ethereum prices by increasing market liquidity.

Options provide institutional investors with sophisticated risk management tools and allow them to hedge price fluctuations. Retailers may utilize these options for speculative profits.

This could lead to a more mature and stable market environment for Ethereum, fostering greater institutional adoption and contribute to mainstream financial integration of cryptocurrency.

Industry experts like ETF store Nate Geraci have shown that the approval process could follow a similar timeline to Spot Bitcoin ETF, which took about 8-9 months from launch to option transaction approval .

If this precedent applies, we can see that Ethereum ETF will become a reality in the near future, potentially next month, assuming the regulatory hurdles are cleared.