Key takes

After the decision on reducing interest rates, the Turmile gained the cryptographic market following the surprisingly Fed’s message of Hawkish. Despite the crash, Bitcoin has made 130 % of this year, but investors continue to accumulate.

Please share this article

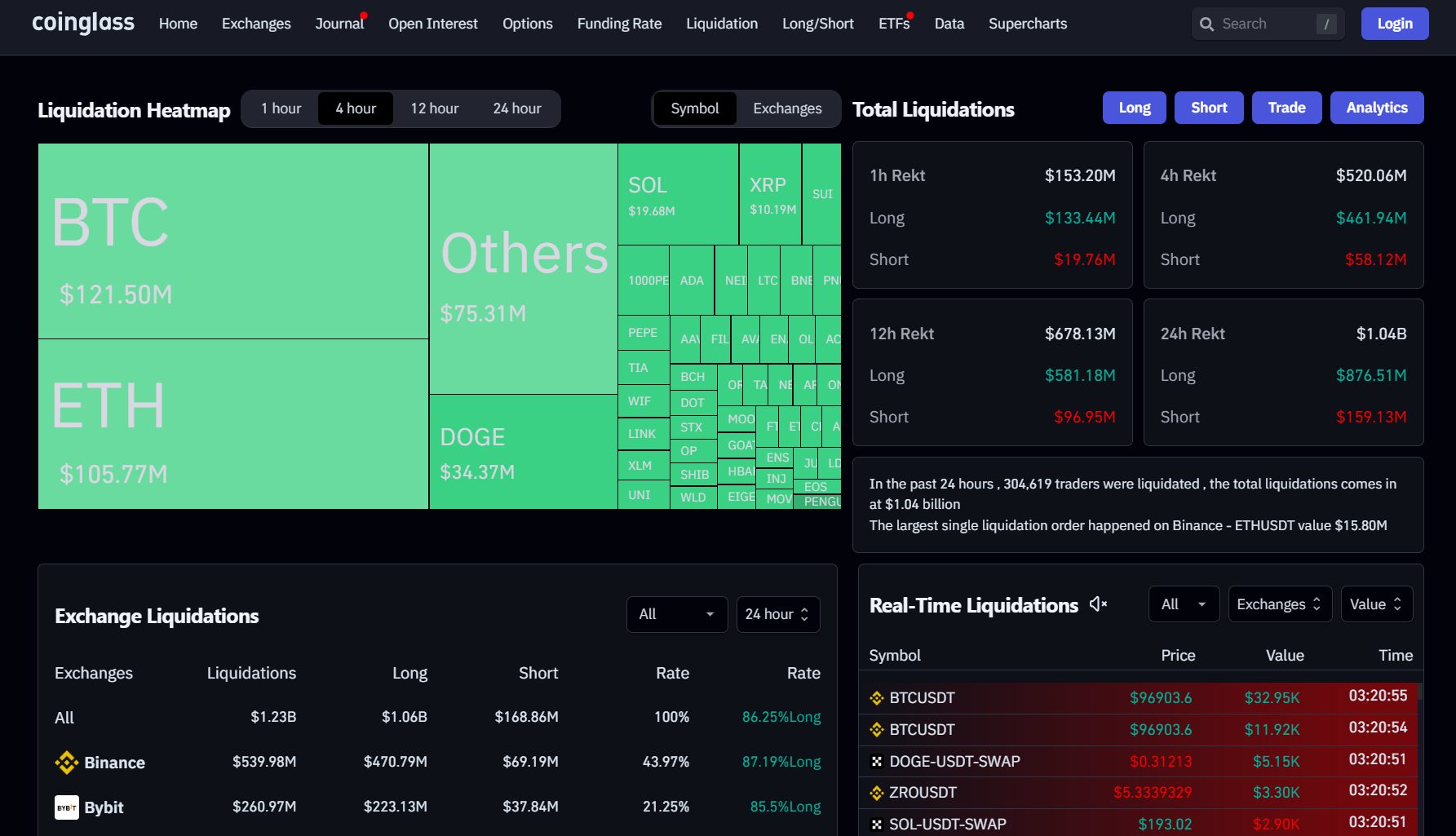

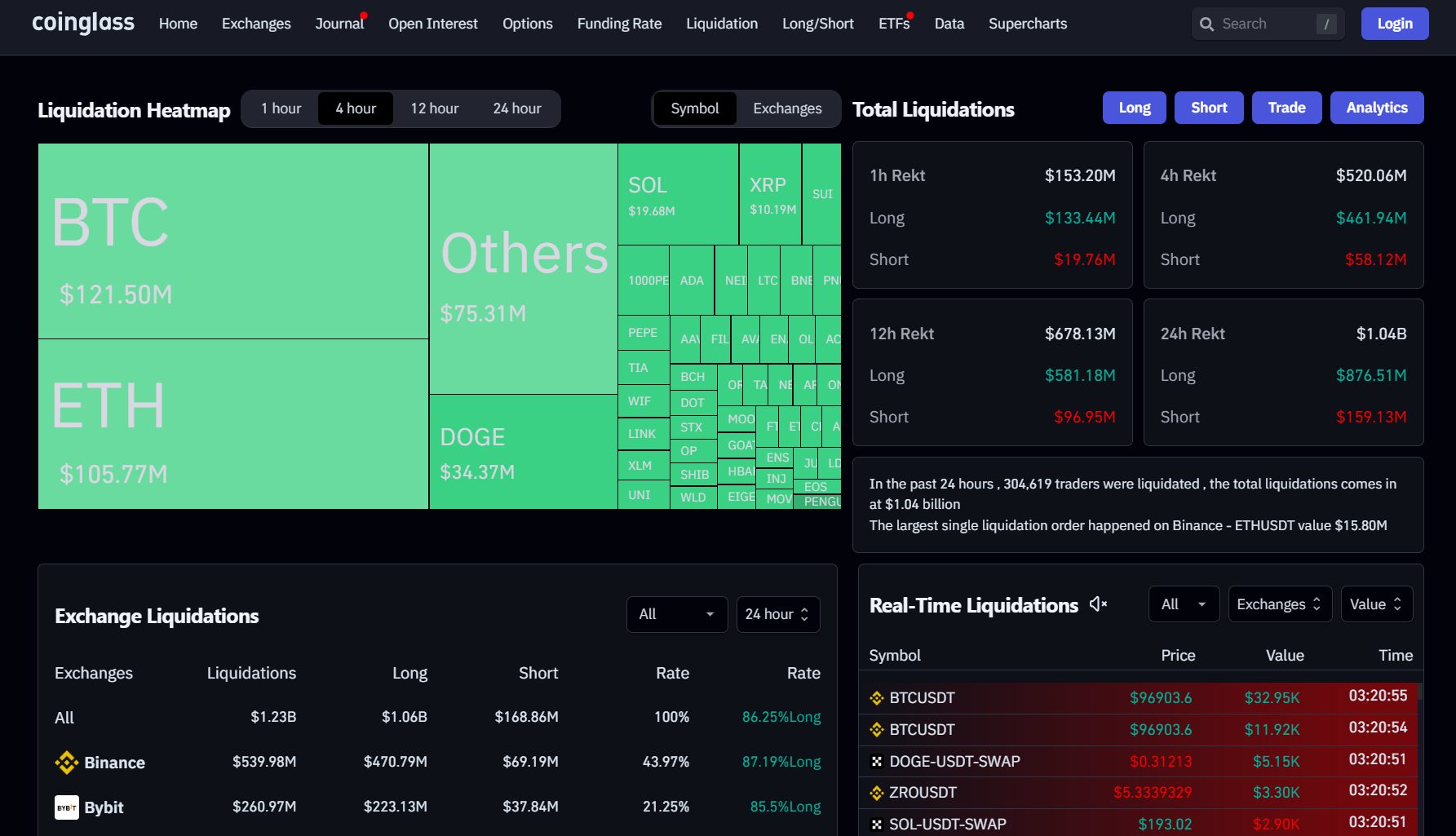

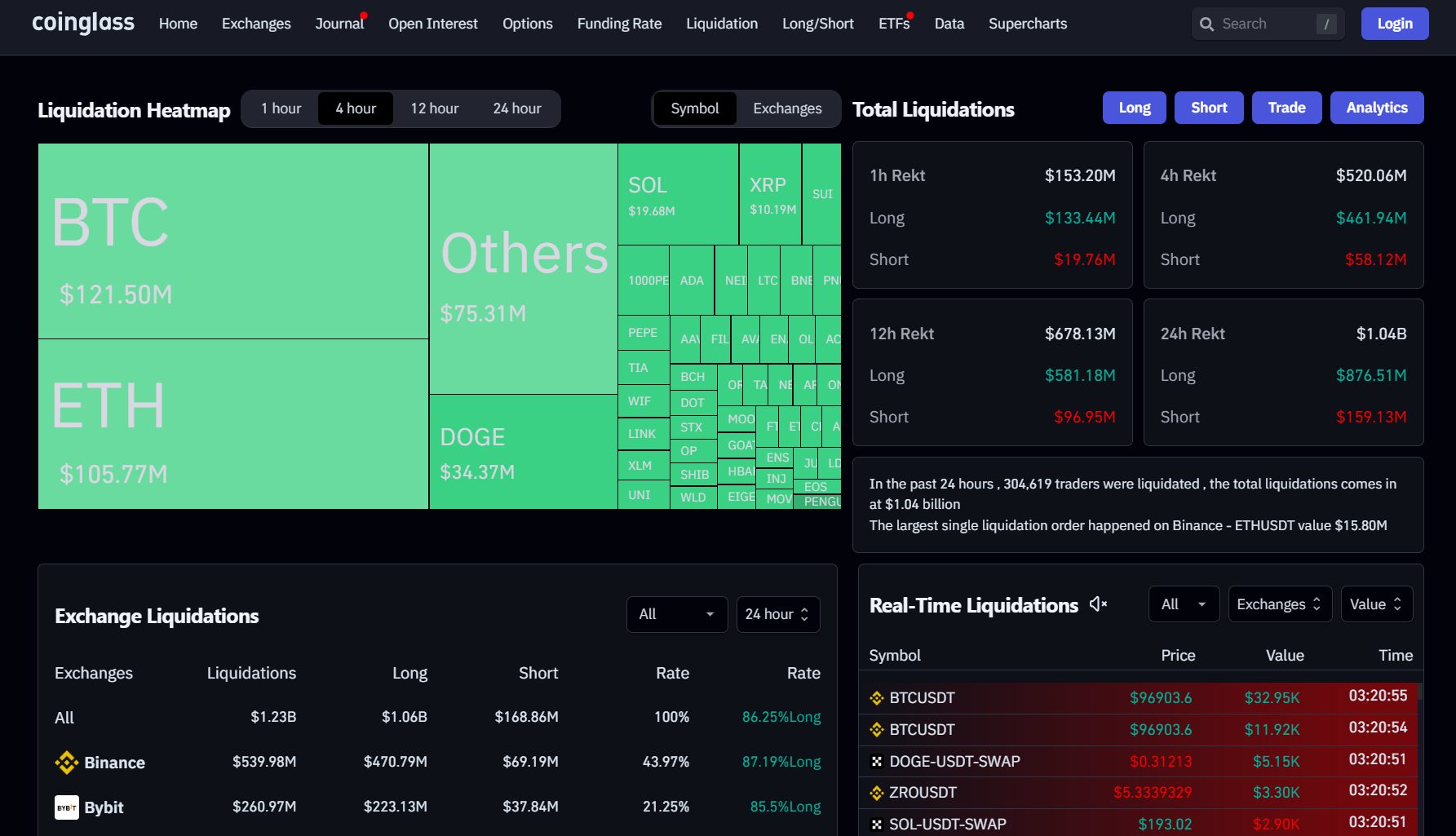

According to Coinglass data, Bitcoin’s cruel sale below $ 96,000 on Thursday, and the liquidation of the entire cryptographic assets has surged to $ 1 billion.

Long positions accounted for about $ 878 million, compared to the short position of $ 160 million.

According to COINGECKO data, bitcoin rebounded over $ 97,000 at the time of press, but has a daily peak of less than $ 102,000.

It was not just bitcoin. Most encrypted assets have declined. Total codal market capitalization was reduced to $ 3.4 trillion at $ 3.4 trillion at the time of reporting.

ETHER lost 8 %, Ripple had 5 %, and Solana and Dogecoin had a more sharp two -digit loss in the past 24 hours. Smaller cap assets were particularly violently attacked, and only movement (movement) reduced the loss.

FED Hawkish Stance

The market may have been confused by the FRB’s unexpected hawk message following the decision to reduce interest rates. Wednesday Fed has reduced 25 -base point rates, but has shown that the reduction in 2025 is small.

The uncertainty of the economy, especially the next administration, urged the Central Bank to adopt a more cautious posture. Fed chairman Jerome Powell said that it would be wise to be “late” if the economic outlook was unclear.

Inflation has been cooled from the peak of about 9 % in June 2022, but stubbornly exceeds the Fed’s goal. Lowering interest rates can stimulate economic growth by lowering borrowing, but may also contribute to higher inflation.

Wall Street is worried that the economic policy proposed by Trump, including tariffs, could worsen inflation, but may promote economic growth in the short term.

Bitcoin ETF performance

Other places in the Bitcoin ETF market, emerging indicators suggest a potential change in emotions.

The US spot bitcoin ETF maintains a 14 -day positive floating muscle, but recent pure inflow is inconsistent with BLACKROCK’s Ibit. Other ETFs report one of the zero net flow or the outflow of the net.

According to the data, the low -cost Bitcoin ETF of the GraysCale had approximately $ 188 million on Thursday, and the GraysCale Bitcoin Trust had a net flow of about $ 88 million.

Further data released today will provide more comprehensive evaluation of ETF performance.

Healthy correction?

Despite the sale, Bitcoin won about 130 % this year. MicroStrategy, which owns almost 2 % of Bitcoin supply, continues its acquisition strategy. The company has purchased a $ 3 billion -worth bitcoin this month.

Many encryption traders consider recent pullbacks as healthy fixes.

“It’s the same story every time, and it doesn’t change. The market is not designed to win. Correction is the natural part of the bullish market,” said the popular analyst “Titan of Crypto.” I mentioned.

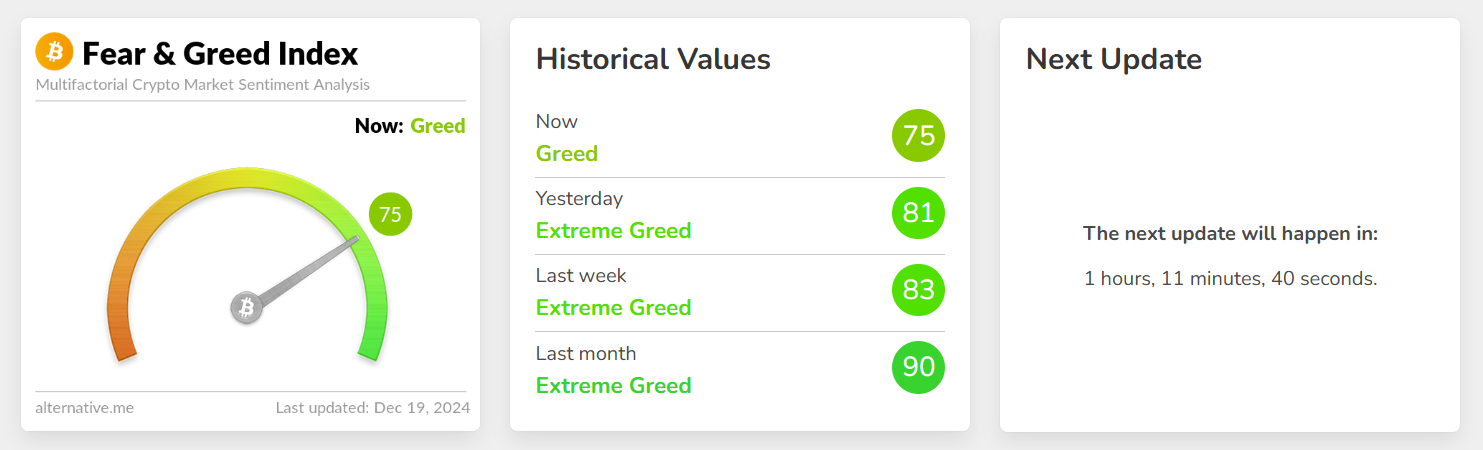

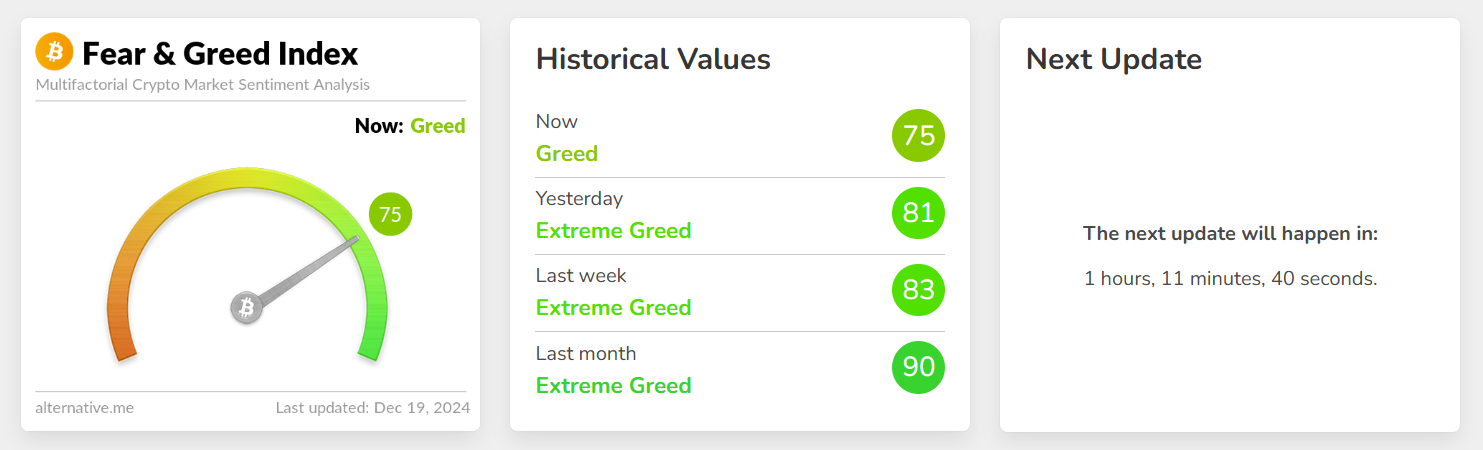

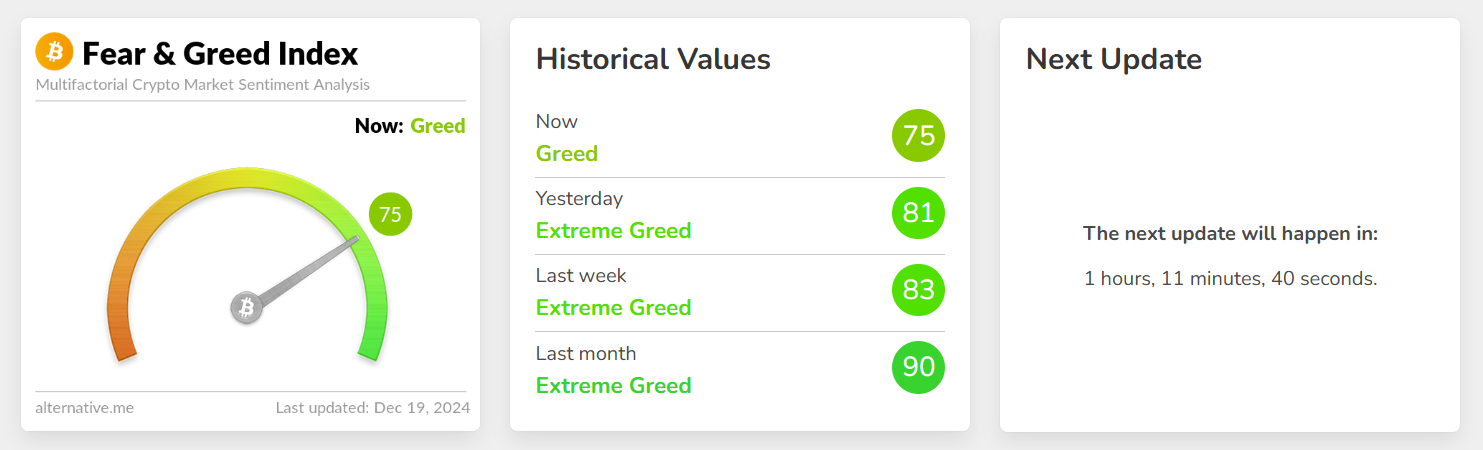

Crypto fears and greedy indices that measure the emotional status of the cipher market are currently located at 75, and despite the recent volatility and price correction, it shows the greed of cryptocation investors. 。

Please share this article