Key takes

Ingrand Bank reduced interest rates to 4.75 %, as the British inflation rose to an 8 month height. The increase in transportation costs and housing costs has greatly contributed to the recent increase in British inflation.

Please share this article

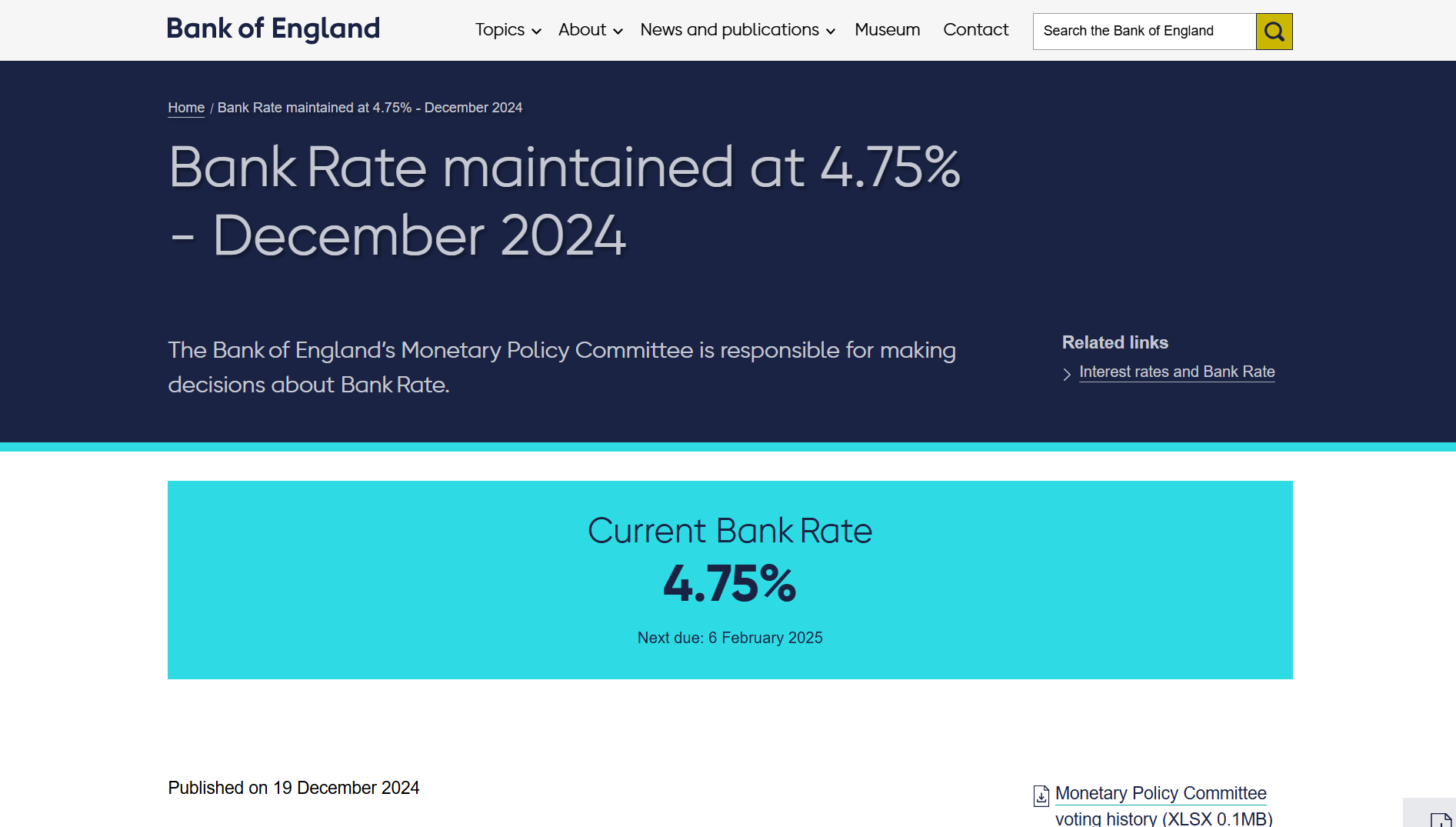

Ingrand Bank (BOE) has decided to maintain interest rates to 4.75 % in re -acquisition of British inflation. Part A meeting of the monetary policy committee announced on Thursday. The decision to change the fee was made in 6-3 votes, and three members advocated 25 base points.

According to data released by the National Statistics Bureau today, the UK inflation rises in November 2024. The Consumer Price Index (CPI) rose to 2.6 % in November, rising from 2.3 % in October, marking two consecutive monthly increases, exceeding 2 % of the central bank goals.

The consumer price index, including the owner’s occupation (CPIH), which is a desired inflation indicator of the UK, rose from 3.2 % in October to 3.5 % in November.

The prices of British products and services are rising faster than in October. This increase is promoted by factors such as increased transport costs and rising housing costs. The overall inflation rate is increasing, but the increase rate has declined compared to the previous month.

The recent number of inflation numbers is not exceeding the market expectations, but it may be actually easier to reduce some inflation pressure, but the sustainable inflation of the service department is for the central bank. It is still an important concern.

The service department, which accounts for about 80 % of the British economy, has a stubborn high inflation rate, urging the central bank to maintain a cautious approach.

Economists had already excluded the potential of rate reduction from the current 4.75 % as soon as the British inflation was generated because BoE aimed to maintain a 2 % target inflation rate.

BOE’s decision is made after the US Fed has reduced interest rates by 25 Basis points and meets the market expectations. The Bank of Japan on Thursday also maintained the current interest rate.

The decision of the US Central Bank was consistent with the prediction, but the Fed’s message was surprisingly Hawkish.

FRB Chair Jerome Powell has signaled a slow pace of future reduction given that inflation has exceeded the 2 % goal. In 2025, the decrease in interest rates may be limited to two, not four, closely at the economic situation.

The global market was a hit following the Fed Hawkish Signal.

The US shares experienced the largest daily decrease of each month, and the main indexs have significantly lost. The European stocks also fell down, reflecting a wider range of sales according to the Fed’s stance.

The risks of risks, such as bitcoin, have faced the downward pressure as the market emotions turned attention. Bitcoin prices decreased by about 6 %, trading less than $ 100,000 on Wednesday evening, and exceeding $ 102,000 for each TradingView.

Please share this article