Key takeout

Two Ethereum whales risk compeling liquidation due to lower ETH prices. If the price threshold is broken, a total of 125,603 ETH for manufacturer protocols could be liquidated.

Please share this article

Due to price fluctuations in Ethereum, whales are vulnerable to Makerdao and are at risk of liquidation, so 125,603 ETHs have 125,603 ETHs worth around $238 million.

Data tracked by blockchain analytics platform Lookonchain shows that one whale controlling approximately 64,793 ETH is close to a liquidation price of $1,787.

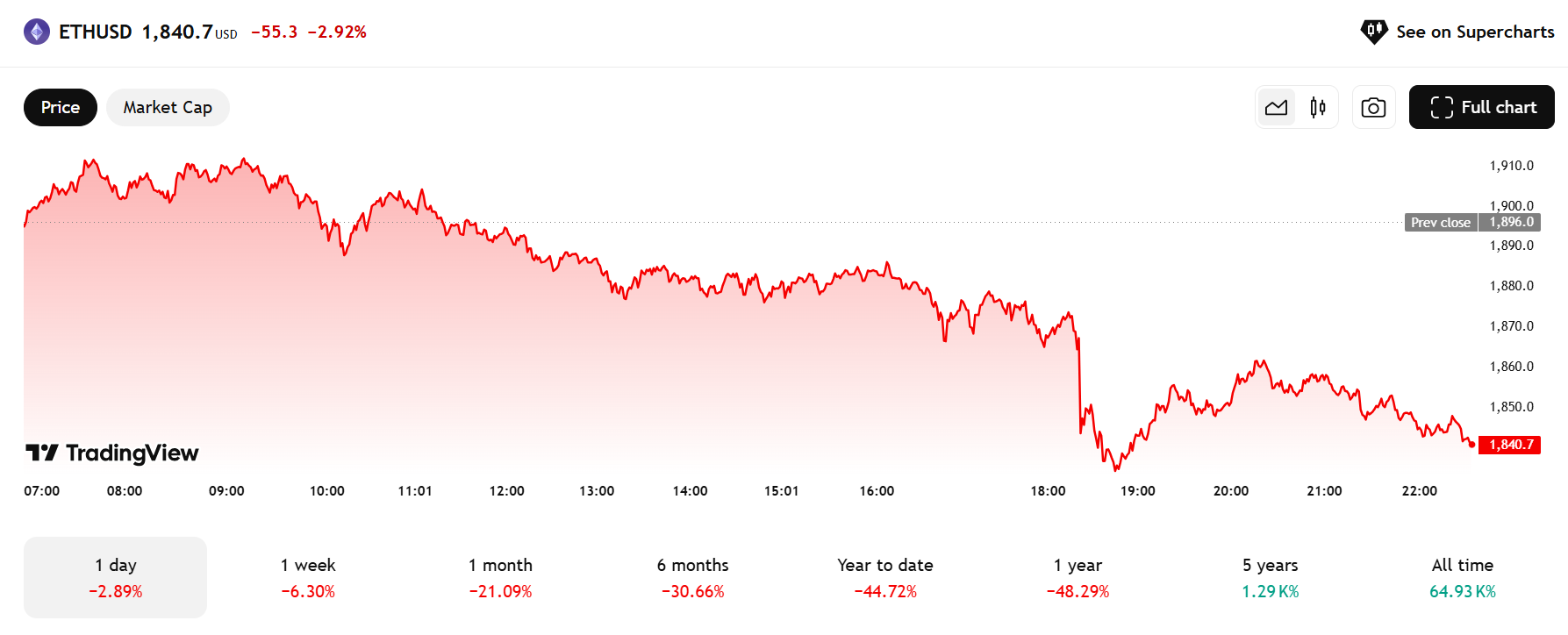

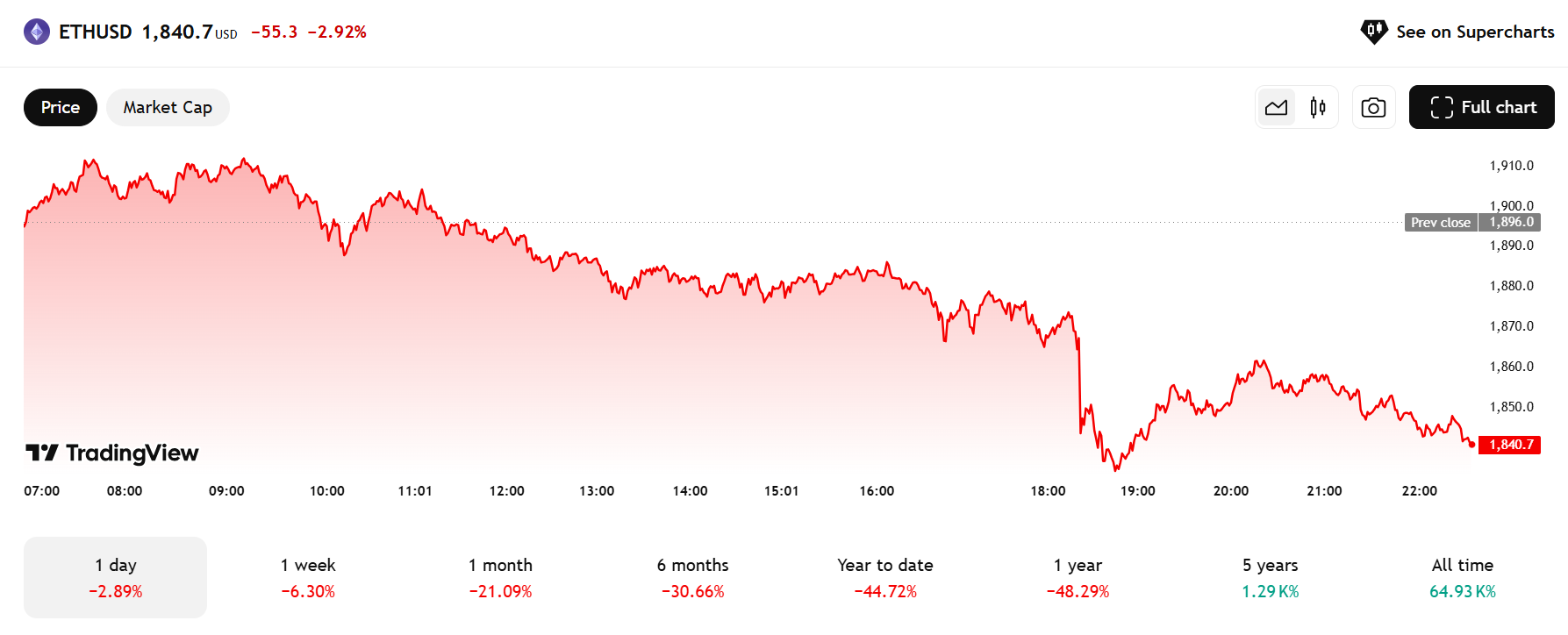

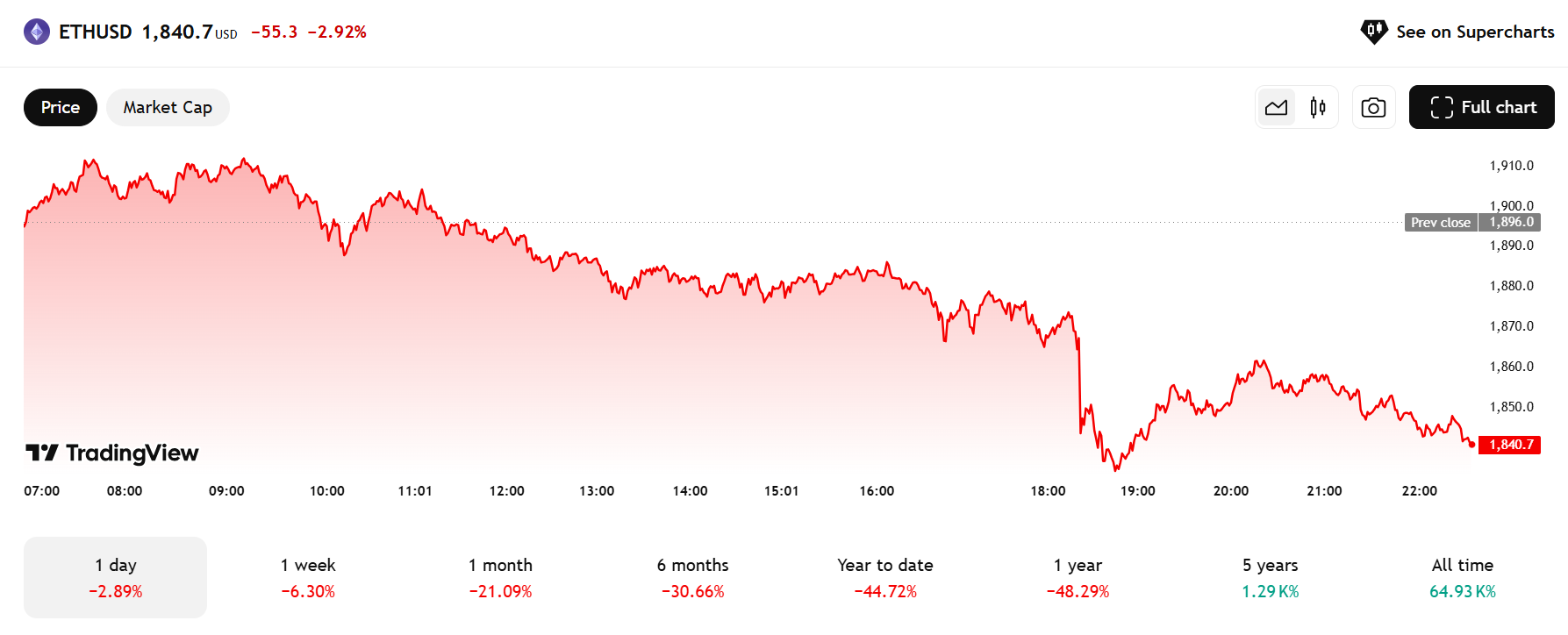

ETH’s deal is $1,841 at press, and the whale is just $54 from the liquidation price.

Traders narrowly avoided liquidation on March 11 by partially repaying their debts after a sharp decline in ETH prices.

However, the current recession puts my position at risk, with the health rate now at 1.04. Continuous price drops can lead to automatic liquidation.

Another whale deposited 60,810 ETH as collateral to borrow DAI 75.69 million with a liquidation threshold of $1,805. When ETH prices fall below this level, the location faces automatic liquidation.

ETH is under $1,900 amid ETF drugs, hacker dumps and market slumps

Ethereum has fallen below $1,900, marking a 6% decline in the last seven days amid turbulence across the market. Separately, a series of negative catalysts weigh heavily on the price of crypto.

The growing fear of inflation and disappointing US economic data have led investors to reduce their exposure to risky assets, including crypto assets. President Trump’s announcement of mutual tariffs, scheduled to take effect on April 2, further heightens market uncertainty.

Bitcoin recovered slightly to $82,800 after a brief fall at under $82,000 early on Saturday.

Currently, BTC is trading around $82,400, reflecting a nearly 2% decline over the past week, according to TradingView data. Bitcoin pullbacks also drag Altcoins, including Ethereum.

In the ETF market, US-listed Spot Ethereum Funds showed a slower performance.

Between March 5 and March 27, investors subtracted more than $400 million from these funds, according to data from Farside Investors. The trend reversed yesterday when ETFs gathered for nearly $5.

While the slow intake has weakened investor enthusiasm, it is expected that potential that allows for staking functions will help increase demand for ETFs. Many ETF managers are seeking SEC approval to add staking to existing Spot Ethereum ETFs.

Another factor that could affect the price of ETH is the sale caused by hackers who dump large quantities of stolen Ethereum.

According to early reports from Lookonchain, hackers recently offloaded 14,064 Ethereum from Thorchain and ChainFlip.

Hackers are dumping $eth!

Two new wallets (possibly related to hackers) receive $14,064 ETH from #thorchain and #chainflip, followed by an average selling price of 1,956.https://t.co/hsp1prgpulhttps://t.co/6axvl6d7dgdgd7dgpic.twitter.com/7rocgmdd

– lookonchain (@lookonchain) March 28, 2025

Please share this article