Key takes

Bitcoin experienced the worst weekly performance with the potential tariff plan of powerful dollars and Trump. Despite the short -term task, the long -term tailwind of bitcoin and digital assets remains the same.

Please share this article

In the aftermath of the presidential election on November 5, more than 45 % of Bitcoin had already lost steam. Analysts expect a tariff plan proposed by President Donald Trump to increase the profits of bonds, strengthen dollars, and pressure digital assets, so that more turbulent streams are advanced. 。

“The current Bitcoin problem is a strong dollar,” said Zack Pungle, a research manager of Grace Kale Investment Mens, and said to CNBC and that some of the recent FRB signals helped to strengthen the dollar. 。

According to Coingecko’s data, Bitcoin regained $ 102,000 this Monday and has a powerful start. But the rally was short -lived. Flagship encryption assets were below $ 97,000 the next day, and slides extended to the end of the week.

“I think drawdown for the past two days is mainly due to the market that is starting to understand that all aspects of Trump’s policy agenda are not a plus for bitcoin,” the recent decline. In the market that added that Trump’s proposed tariff planning causes uncertainty.

CNN reported on Wednesday that Trump is considering declaring a state economic emergency to promote his plan to carry out universal tariffs. This can produce various inflation pressure in combination with related economic policies. However, there is no final decision on this declaration so far.

Although there was an early optimism in the parent -crypto environment under Trump’s administration, the inconsistent signal in the range of tariffs could create a bitcoin -like volatility and had a negative effect on risk assets.

Continuous high interest rate

In December 2024, the stronger salary than expected indicates that the Fed is unlikely to be urgently urgently urgently into low interest rates to stimulate the economy. Following the report, investors have reduced their expectations for short -term interest rates.

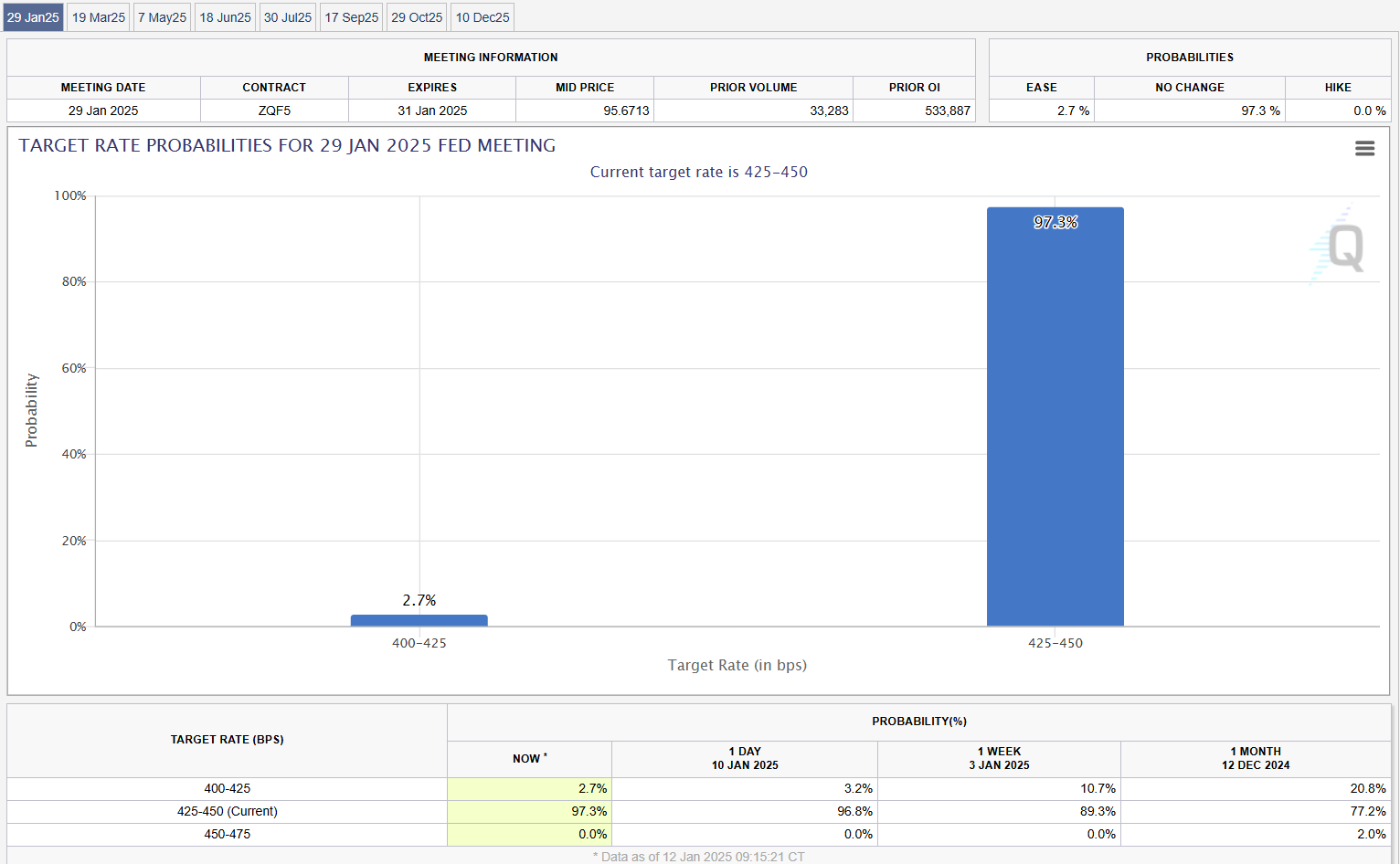

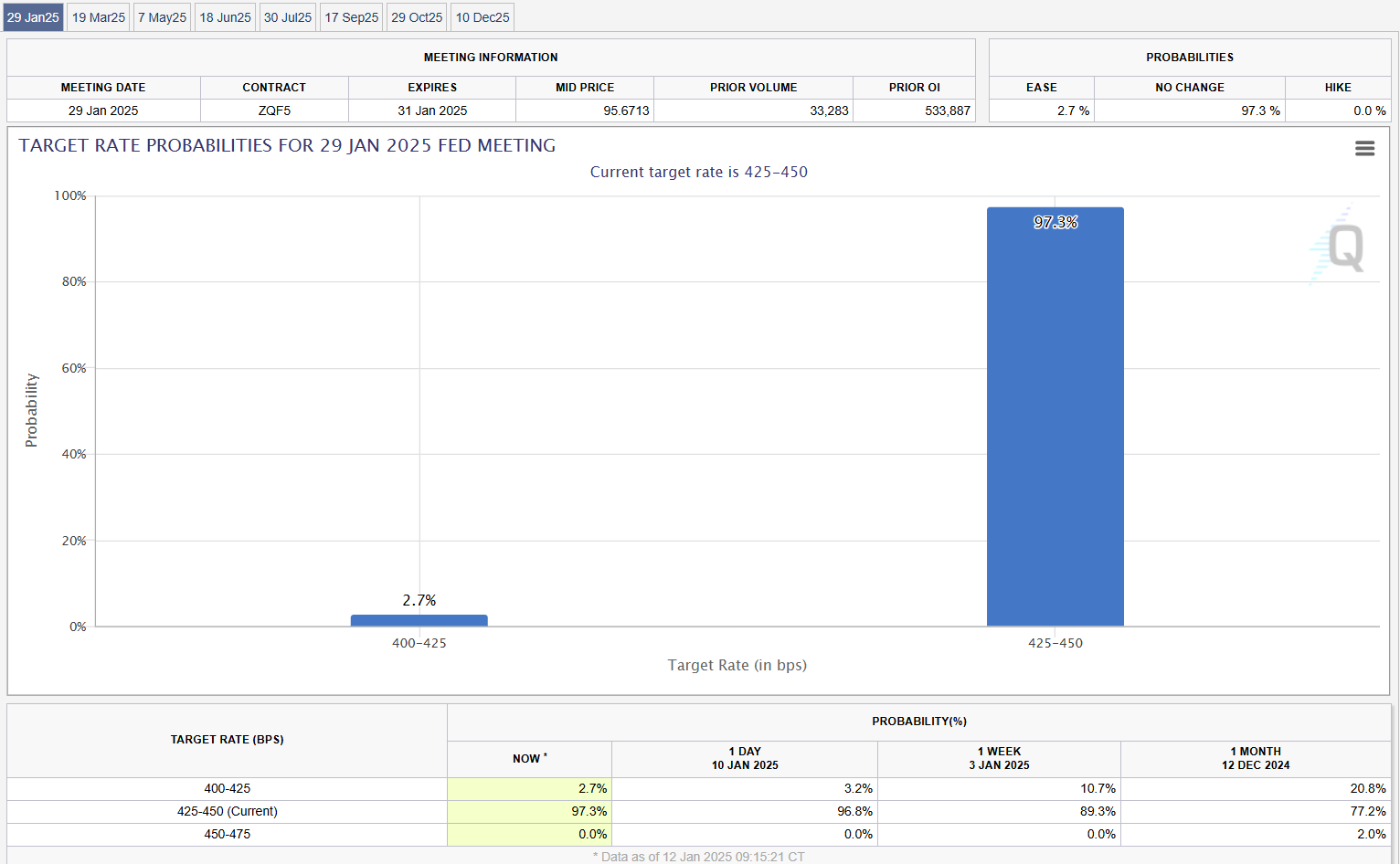

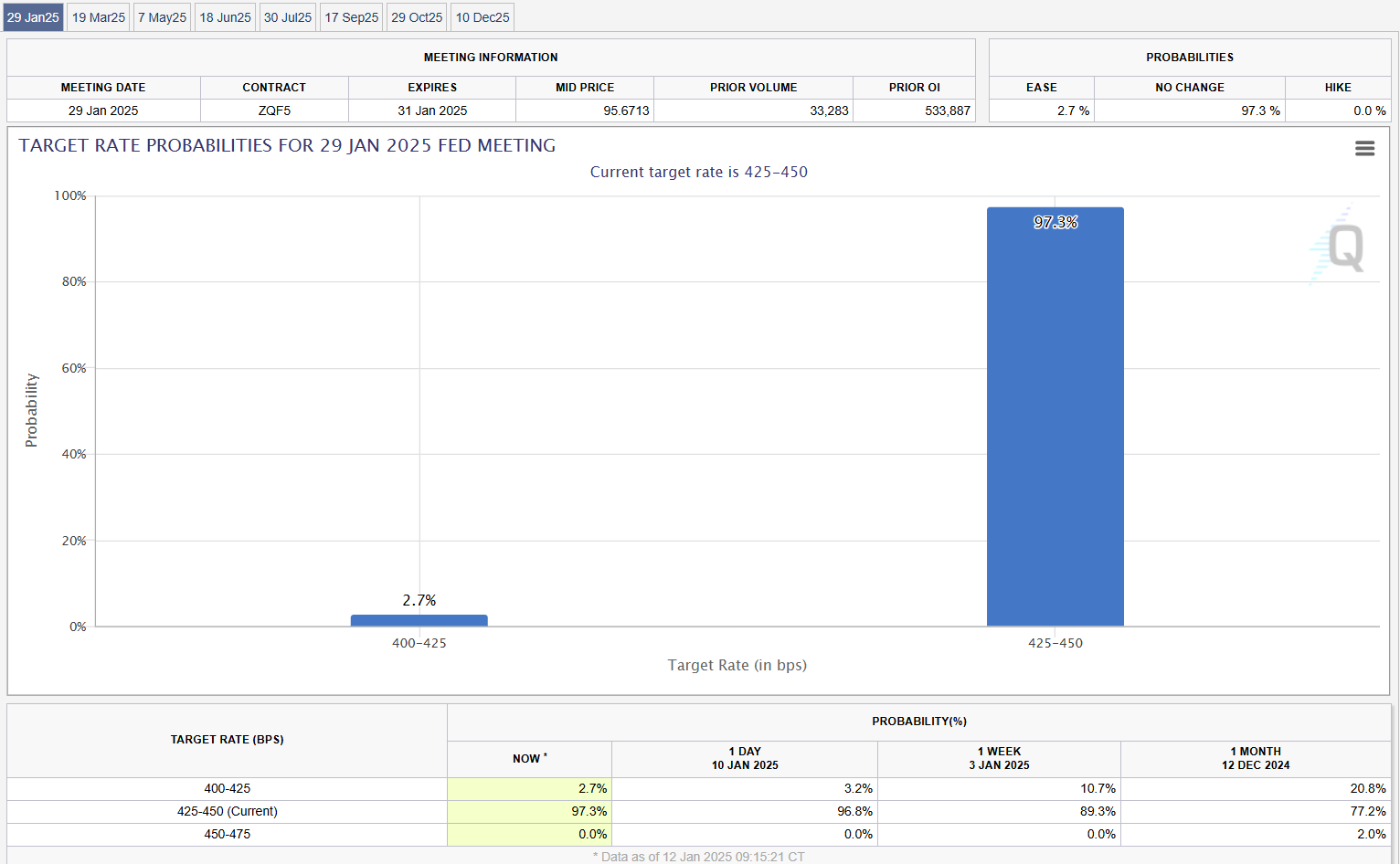

At the latest data of the CME FEDWATCH tool, the market participants may not change interest rates with a 97 % possibility during the meeting held on January 28-29.

The Fed has reduced 25 base points last month, but also provided a Hawkish message that shows a cautious approach to move forward. This year, the Central Bank has predicted only two interest rate reductions this year, decreasing from the previous predictions due to the ongoing inflation pressure and economic situation.

According to Alex Thorn, Galaxy Digital researcher, the cautious Feds and uncertainty surrounding Trump’s economic agendas “despite the long -term structural tailwind of bitcoin and digital assets, risk assets Is engraved every moment in the short term. ” 。

Crypto agreement may take some time

According to JPMORGAN’s analyst Kenneth Worthtington, the parliament is expected to prioritize non -crypto issues in the next three months, so the potential positive effect of the laws in favor of the crypt may not be promptly realized. No.

However, Warginton is convinced that Congress ultimately return its precautions to digital assets and take important cryptocation -related laws, including potential frameworks for stability and market structure.

The New York Digital Investment Group (NYDIG) has the same perspective.

Recent reports suggest that NYDIG’s research officer Greg Cipolaro is unlikely to change encrypted policy. He pointed out various government processes, such as official appointments and confirmation, and could delay new policies.

Analysts can also prioritize other legislative priority, and can further delay cryptographic initiatives despite the general positive outlook on digital assets from Trump’s future appointment. He pointed out that he has sex.

Please share this article