Key takes

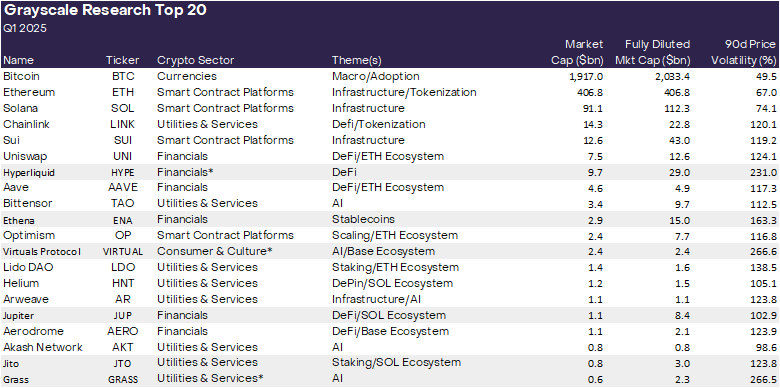

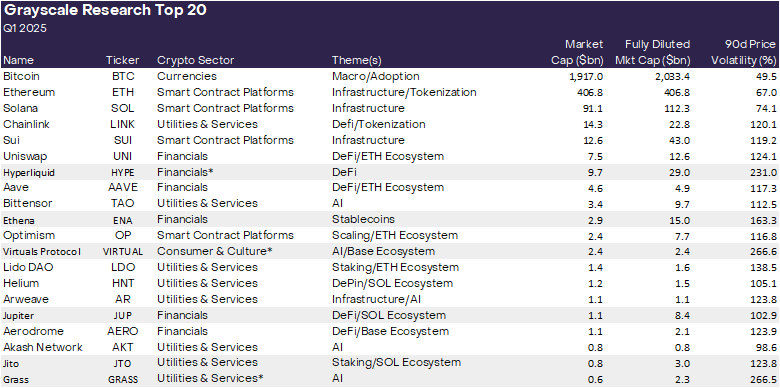

Grascale research has added high lipids, etenas, virtual protocols, Jupiter, Jito, and grass to the top 20 cipher assets in the first quarter of 2025. The company’s list focuses on the growth of distributed AI technology and Solana ecosystem.

Please share this article

As 2024 approaches the end, GRAYSCALE RESEARCH has released a list of top 20 encrypted assets, which will be functioning well in the future. This list has six new altcoins, including HyperLiquid, Eetena (ENA), virtual protocol (virtual), Jupiter (JUP), JITO (JTO), and grass (grass).

Grayscale Research pointed out that these updates are influenced by the themes of US elections, the progress of distributed AI technology, and the growth within the Solana ecosystem. The team predicts that these will be an important theme for the first quarter of 2025.

The distributed AI platform was previously included in the GRAYSCALE Q4 2024 list and had Bittensor (TAO). In the next quarter, we focus on this sector by including virtual and grass.

Virtuals Protocol, released in Base in October 2024, allows users to create, deploy AI agents, and monetize AI agents without needing technical expertise. The virtual token has reached $ 1.4 billion within one month of launch. According to COINGECKO data, the largest AI agent coin with a market capitalization of $ 3.4 billion at the time of pressing.

The grass that utilizes both the growing AI and Solana ecosystem is a distributed network built based on Solana’s layer 2. Glast token has increased rapidly by about 160 % since its release in late October for each coingecko.

High -lipids, on the other hand, emerge as a leader in the amount of transactions and total value locked between the distributed permanent swap platform. The hype advertising token has risen about 300 % since its release on November 29, reaching $ 28.

Jupiter leads as Solana’s major DEX agrigator and has a total value of the highest value, but JITO, a liquid sterry protocol that raised more than $ 5550 million in 2024 in 2024, JITO. We emphasize highlights of Grace Kale.

In addition to new additions, six assets (ton coins (tons), near (near), stacks (STX), manufacturers (Mkr), Celo (Celo), and UMA protocols (UMA) have been removed from the list.

According to GrayScale survey, these projects are related to Crypto Ecosystem, but the team believes that the revised choice will provide a more convincing return profile in the following quarter.

Smart Contract Arena

An important observation from GraysCale’s research is the expansion of competition in the smart contract platform segment. Ethereum won several major victories in the fourth quarter, but faced competition pressure from other blockchain, especially Solana.

In addition, investors are starting to see other alternatives of Ethereum like SUI and Ton. According to GrayScale survey, these platforms are There are various approaches in “blockchain” Trilema. “

The team repeats when the revenue of the commission is an important propulsion for the value of the smart contraduct platform token. They suggest that the ability to generate platform fees is directly related to the market. Ability to capitalize and reward Token holders via mechanisms such as talk -burning Staking.

“” big Ability to create a network, big Network abilities that give value to the network in the form of tokens burning or stakeen rewards. In this quarter, the function of GraysCale Research Top 20 Next Smart Contract Platform: ETH, SOL, SUI, OP “is written.

Please share this article