Key takes

Solana’s market structure, like Bitcoin and Ethereum, indicates powerful fluidity and price correlation. The survey suggests that Solana’s effective spreads and trade costs meet Bitcoin and Ethereum’s effective spreads or beyond that, and supports the preparation for ETP in the United States.

Please share this article

The market structure of SOLANA (SOL) indicates a deep fluidity and a strong exchange price correlation, equivalent to Bitcoin and Ethereum, and for regulating replacement trade products (ETP) in the United States. According to the new analysis co -, the former SEC Chief Economist James Overdal and Craig Lewis have written.

The US regulatory authorities have not yet greened Solana ETP, but the approval of bitcoin and Ether ETPS indicates a mature encryption market and provides frameworks to evaluate other digital assets.

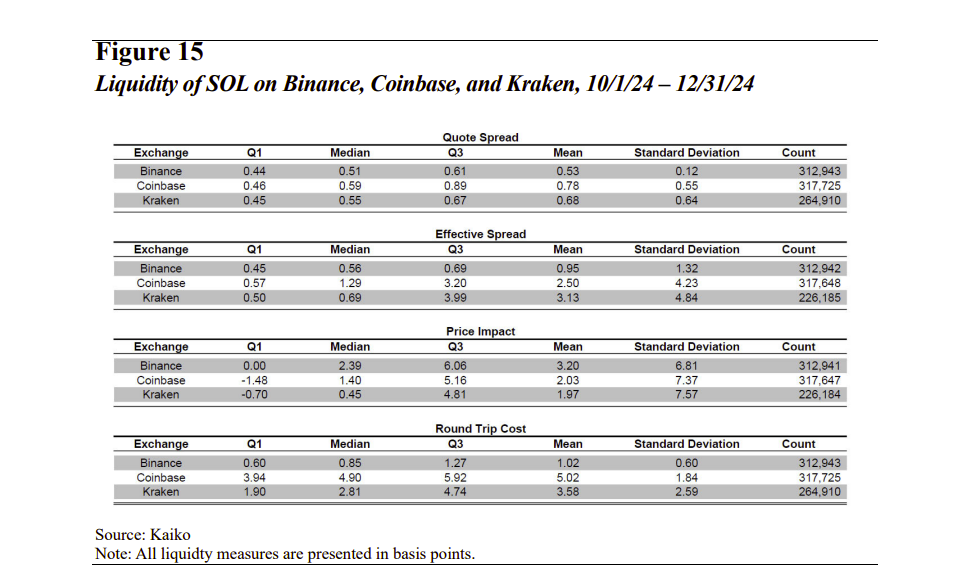

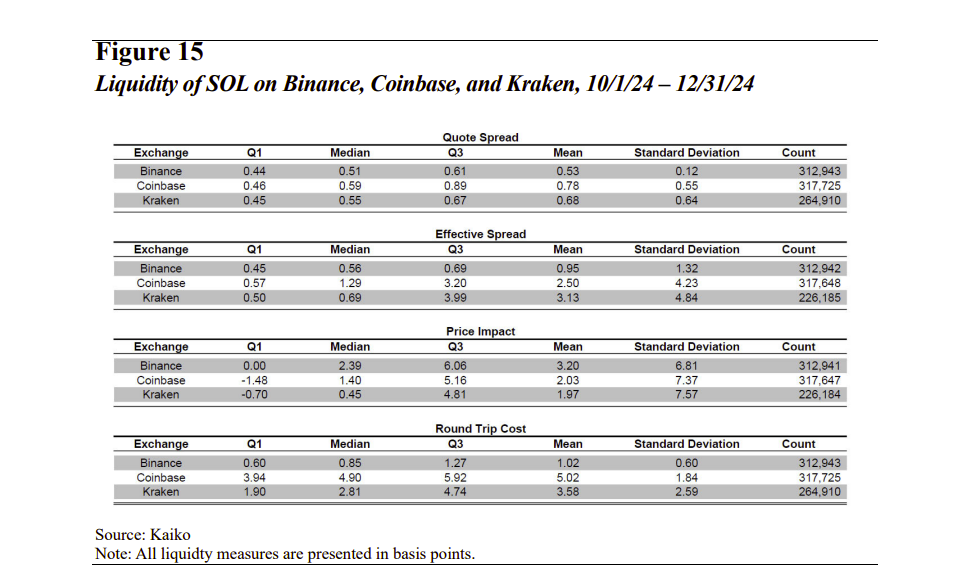

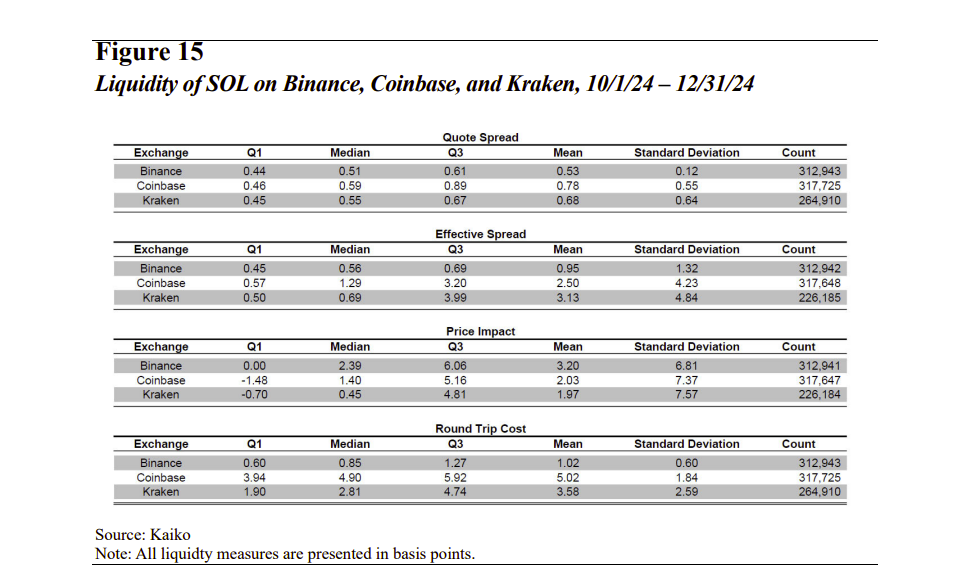

Based on the framework, Overdar and Lewis are important factors that regulatory authorities consider whether the regulatory authorities are examined whether the regulatory authorities are suitable for whether the regulatory authorities are suitable for the regulated investment products. Is hitting. These include the liquidity of the order book, the effective spread, the trade cost, and the price correlation.

According to the analysis, the depth of the SOL order book is smaller than BTC and ETH, but its fluidity is relatively robust in consideration of its small market capitalization.

Most of SOL’s circulation supply can be easily used for trading compared to BTC and ETH. This is a positive sign of the liquidity of SOL, indicating the ability to process large -scale transactions without a large -scale price fluctuation.

In addition, its effective spreads and trade costs are comparable to those observed in the bitcoin and Ethereum markets, and in some cases.

Researchers have found high correlation between Binance, Coin Base, and Kraken, regarding the correlation between SOL returns, which is another index of the quality of the market and the operation of the market.

The correlation is higher at intervals longer than a short interval. This suggests that a temporary price difference that can occur due to the flowing or fluid flows of order is immediately arbitrated.

Due to high correlation and effective arbitration mechanism, it is difficult to operate the SOL price in a single replacement. Manipulators need to affect the global prices of SOL. This is a much more challenging and expensive initiative.

“The permanent high correlation relationship suggests that the arbitration is functioning effectively, so to operate the SOL price in a single replacement, SOL’s global price. It will be necessary to have a strong deterrence because it will be more likely to be an impact on. “

The combination of high fluidity, low transaction costs, and robust arbitrage mechanisms, like bitcoin and Ethereum, draws a picture of a healthy and functional market.

The regulatory authorities are not guaranteed, but the survey results show Sorana’s compelling case. The powerful market performance and the comparison of Bitcoin and Ethereum can be the main candidates for the next waves of cryptographic investment products listed in the United States.

Please share this article