TELCOIN has been approved by the Digital Asset Bank Charter in Nebraska. This is the position of Telcoin as one of the first -federal -regulated digital asset deposit organizations in the United States.

In the Landmark decision, the Nebrasko Bank Finance Bureau is Telcoin and Inc. Green lights can be given to Nebraska’s Financial Innovation Law (Under LB 1074, it can be one of the first federal digital asset deposit banks in the United States, 2024).

This approval is expected from the public hearing held in December 2024 and has shown an important milestone in the integration of digital assets into conventional banks.

Telcoin business plan

The application for Telcoin in this Charter had a wide range of business plans that hit hundreds of pages with 29 appendices. This document has demonstrated not only the validity of Telcoin’s proposal, as well as the detailed background of directors and officers.

This plan clearly shows the vision of Telcoin issuing a stubcoin for US dollar support called “digital cache” or EUSD.

Conditions for Telcoin to start operation

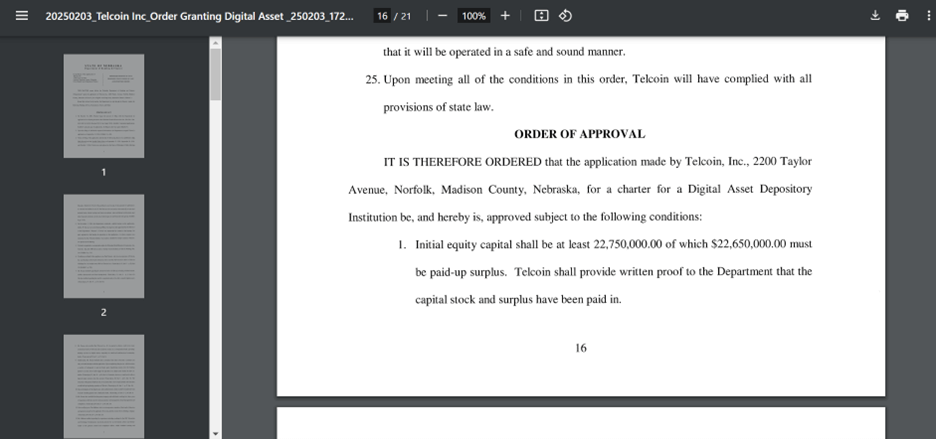

Approval of the digital asset deposit banking bank was granted based on the guarantee that Telcoin operates safely and healthy.

In particular, the thoroughness of witnesses, hearing, and business planning on December 5, 2024 was extremely important in obtaining approval.

In order to operate as a digital asset deposit bank regulated by the US federal government, Telcoin will maintain a fluid asset equivalent to 100 % of the unresolved stubcoin value issued and has not been hindered by the US dollar. It is necessary and needs to secure financial stability and consumer protection.

In addition, providing guarantee or pledges for $ 1 million assets equivalent to $ 1 million, securing responsibility for directors and officers, errors, omitted, and IT infrastructure insurance, and strict regulation conditions equivalent to $ 10 million. You need to comply.

In addition, all US currencies received from customers are retained by Nebraska’s FDIC insurance institutions to ensure customer deposits safety.

Another remarkable aspect of the Telcoin’s Charter includes community involvement and education. The company is in charge of maintaining a public file that can be accessed by anyone and in detail the efforts to meet the needs of the community, such as a financial literacy program for Neblaska students focusing on digital assets, budgets, and credit. I am.

TELCOIN needs to be noticeable that digital asset deposits are not covered by FDIC.

Telcoin also needs to use its complete legal name, Telcoin Bank, Digital Asset Bank in all official communication and branding, to ensure clarity and awareness in the market. The Charter stipulates that Telcoin needs to pay a $ 50,000 charges and cover the hearing -related costs.

Furthermore, before the Telcoin status is fully operated, a significant change in TELCOIN may lead to a correction, suspension, or withdrawal of approval.

When these conditions are satisfied, Telcoin is set to start operation, issuing StableCoins and has legal authority to use the independent node verification network of the payment system.

With this approval, the Nebraska Bank and the Finance Bureau have set a route of digital assets coexisting with conventional banks, focusing on safety, soundness, and consumer education.

This approval may set a precedent on how digital asset companies are operated within the regulation framework and open the way to further innovation of financial sector.