Bibit Hacks raise the fear of centralized exchange security vulnerabilities. President Donald Trump’s trade tariffs are increasing market uncertainty While Trump’s code may have begun to be great, it can ultimately prove devastating

According to the COO of Unity Wallet, three things have contributed to lower crypto prices.

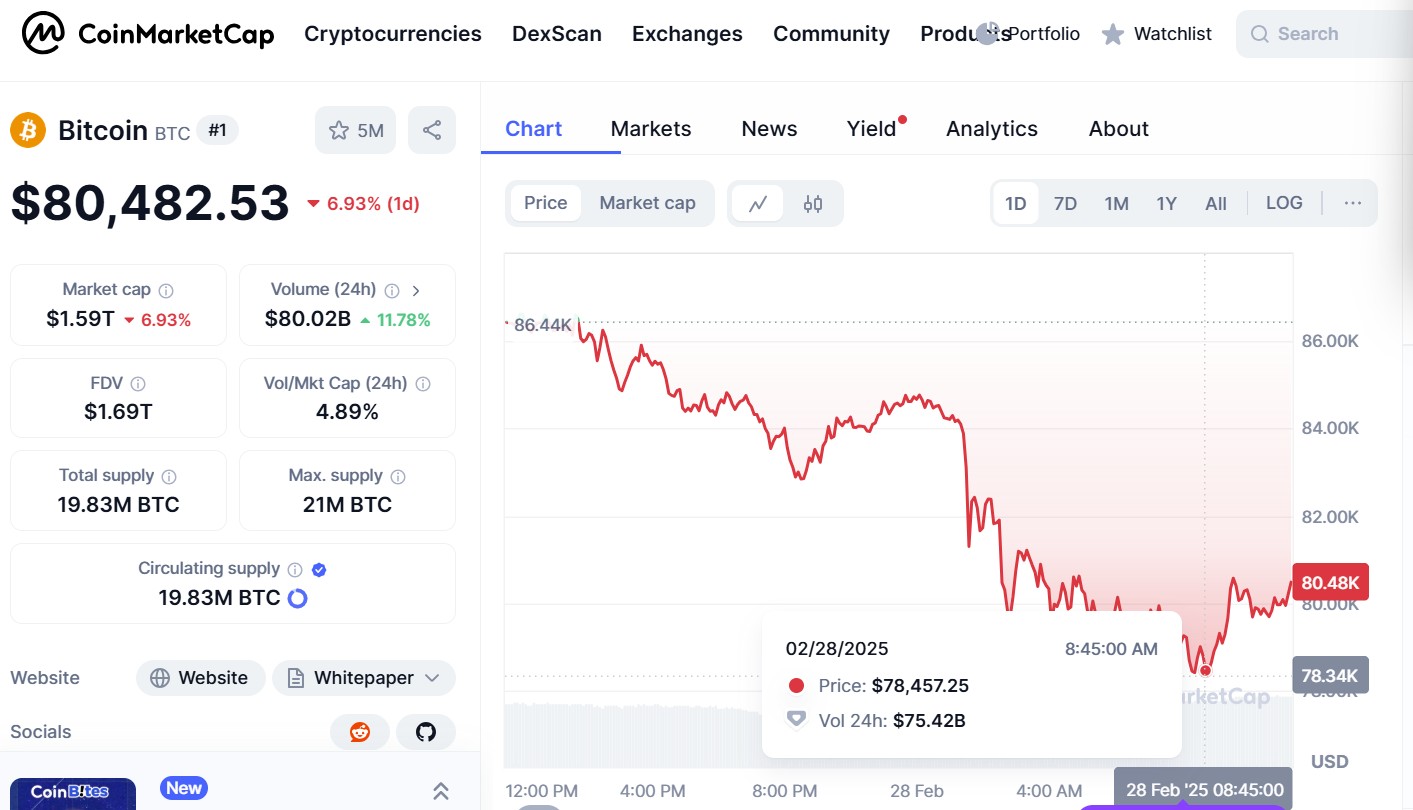

This fell sharply from Bitcoin’s all-time high, reaching $109,000 in January ahead of President Donald Trump’s inauguration.

Optimism sparked a bubble in the post-election crypto market after the election, and “the real-life inauguration is now in place,” he told Coin Journal.

In Toredano’s view, the Buy-bit hack at the Crypto Exchange (which resulted in the $1.5 billion theft near Ethereum) is one of the factors affecting crypto prices.

It undermined investors’ trust, which led to a withdrawal of panic and a total market-wide selling. Bybit CEO Ben Zhou responded quickly to the hack, but the situation “has increased the fear of centralized exchange security vulnerabilities.

Dom Haz, co-founder of Bob, a hybrid layer-2 (“Bitcoin build”), said theft on Bybit was a “stricken reminder of the fundamental industry issues,” adding:

“We’ve been hypnotized by price surges, memocoin frenzy and media spectacles. We forget that crypto is a new financial system. Bybit has given us a $1.5 billion reminder that we’re not approaching that reality.”

Trump’s tariffs

The ongoing market sale follows Trump’s trade tariff announcement earlier this week.

During his election campaign, the US president made a crypto-making promise and said the US would become the “crypto capital of the earth.”

Since entering the White House, he has appointed an individual custody to restructure governmental agencies, namely Paul Akins, as the next chair of the U.S. Securities and Exchange Commission (SEC).

Mark Ueda is currently chairman of the SEC.

Trump has also signed an executive order to establish a cryptographic working group to provide clarity on regulations. It is also expected that the working group will investigate the possibility of national crypto stockpiles.

But despite these steps, Trump’s trade war could soon clash with the EU, the world’s largest trade bloc, with 25% tariffs, increasing market uncertainty.

According to Toledano, Trump’s tariffs are “harming the global economy,” and much of the crypto space feels disappointed by the US president.

“The promises are big and reality can prove to be catastrophic,” he added. “I think Trump understands that the financial industry is interconnected and is becoming more and more converged.”

The greatest economic risk

The third contributor affecting market prices along Toredano is the question of overall US governance.

A Chatham House article suggests that the biggest economic risk from Trump’s presidency is the loss of trust in US governance. Trump’s policies may seem mild in the short term, but I read that steps that undermine the US and its international allies could have lasting effects.

“We rarely get scared of the peaks and troughs that codes present, but when we combine the volatility of traditional stocks with what is happening, I think there’s a source of concern right now,” Toredano said.