The crypto market fell last week as US tariffs shook the market and investors fled to secure stock assets like gold crypto prices, which recovered slightly on Monday and Tuesday. One day’s leak

Bitcoin

Bitcoin prices fell last week following President Donald Trump’s announcement of tariffs in Canada, Mexico and China. Investors have fled to secure assets like gold, but dangerous assets like crypto have been lowered.

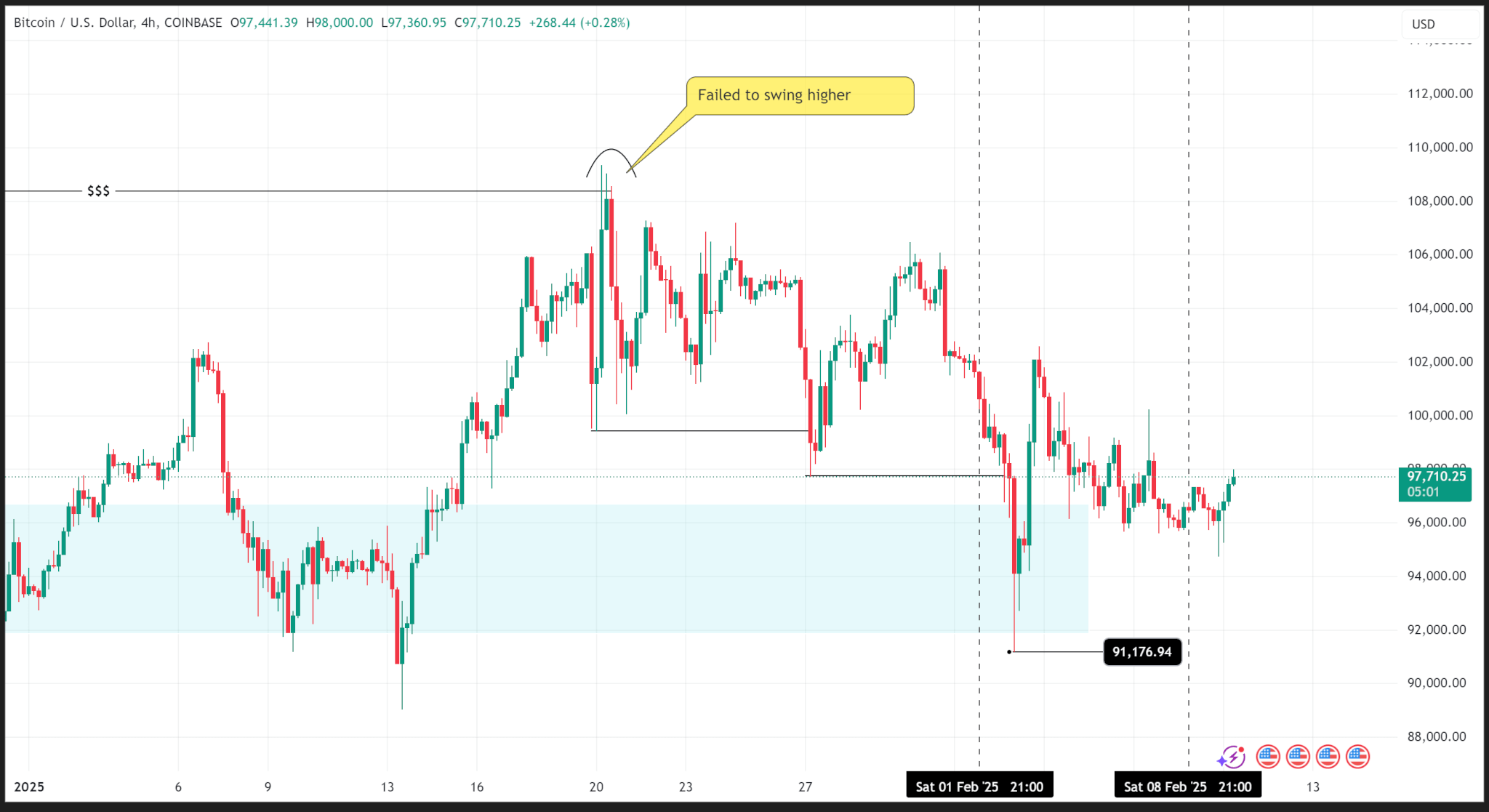

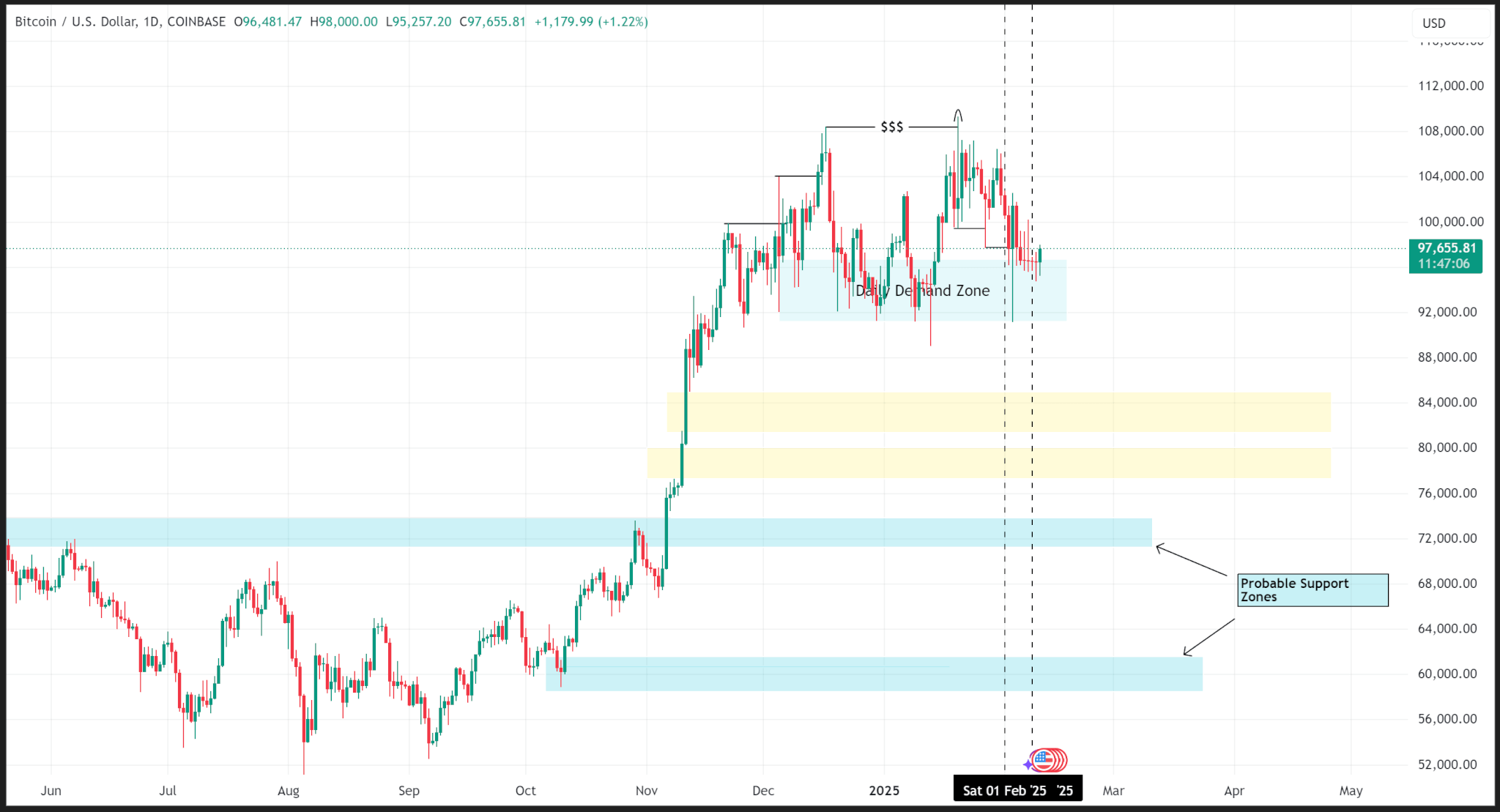

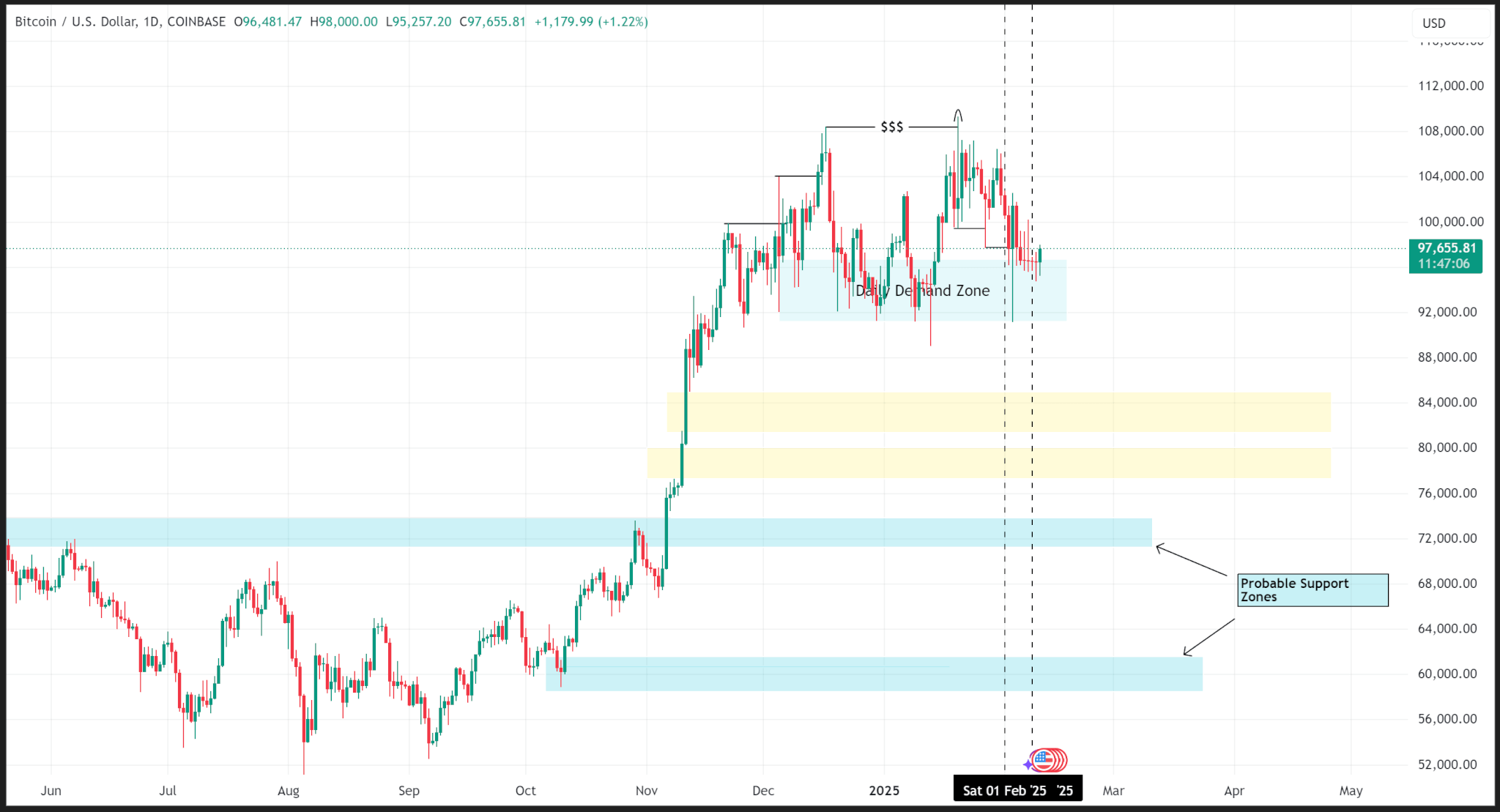

However, tariffs are faster than the price drop as Bitcoin showed that after the price measure did not swing above the $108,000 level three weeks ago, it indicates that Bitcoin had already reduced its substructure decline. It’s a catalyst.

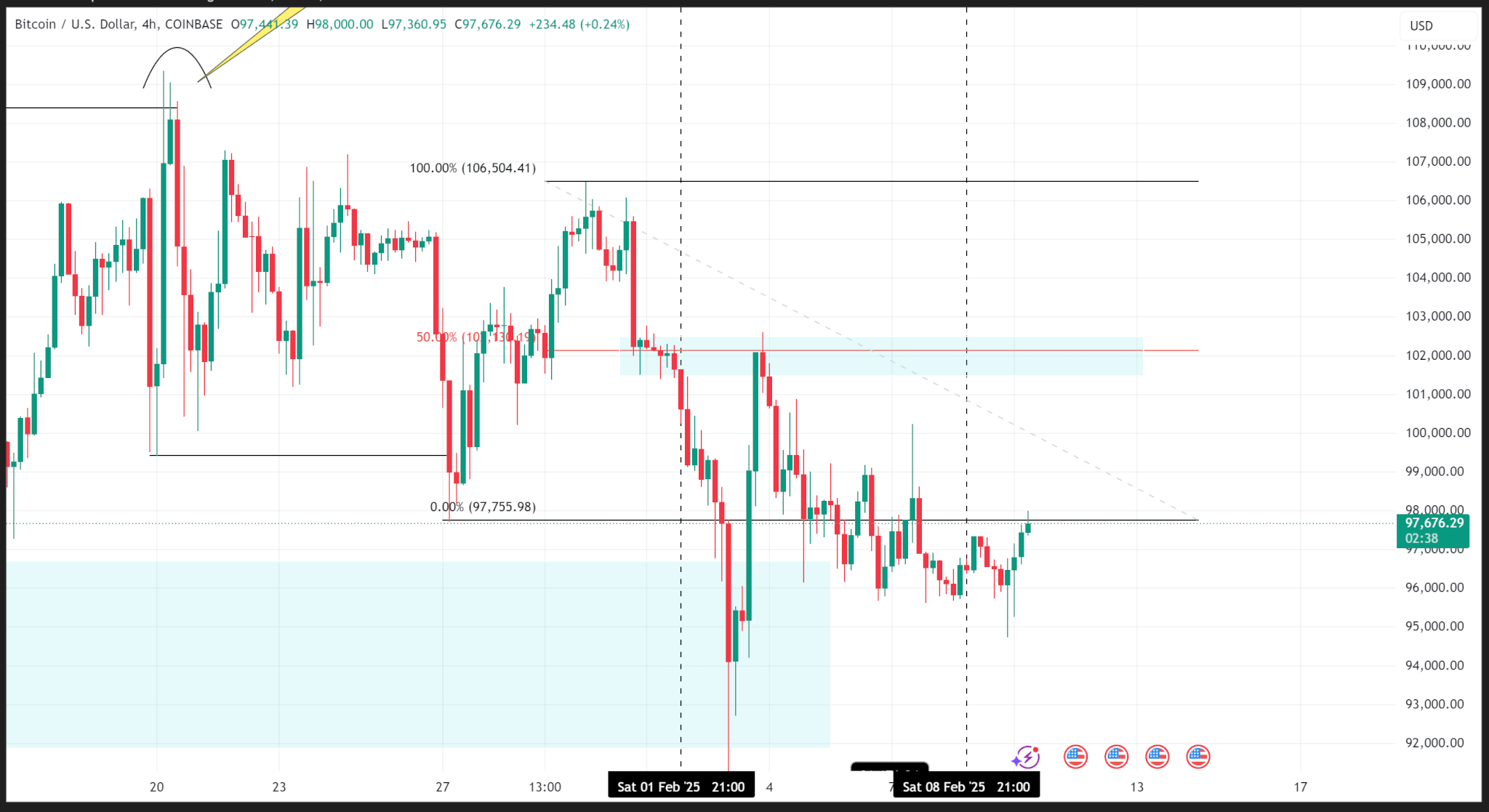

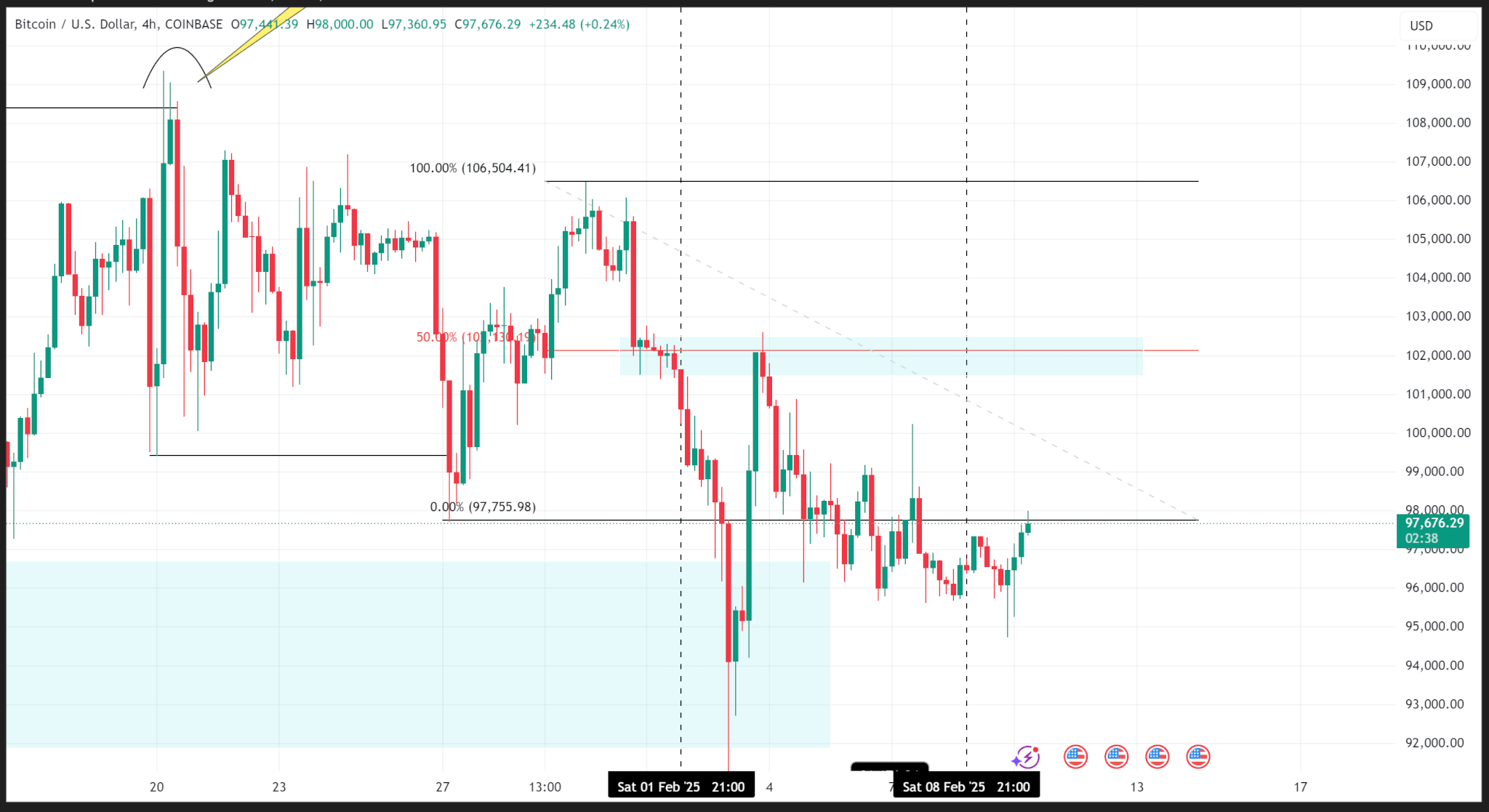

BTC rose its lower lows on the substructure for the last two consecutive weeks, trading with the daily demand zone earlier last week, hitting a weekly low of $91,176.94.

After purchasing from the demand zone, the price rose at $102,000 to an internal supply zone validated at 50% Fibonacci level, selling that zone to close the week at $96,475.03.

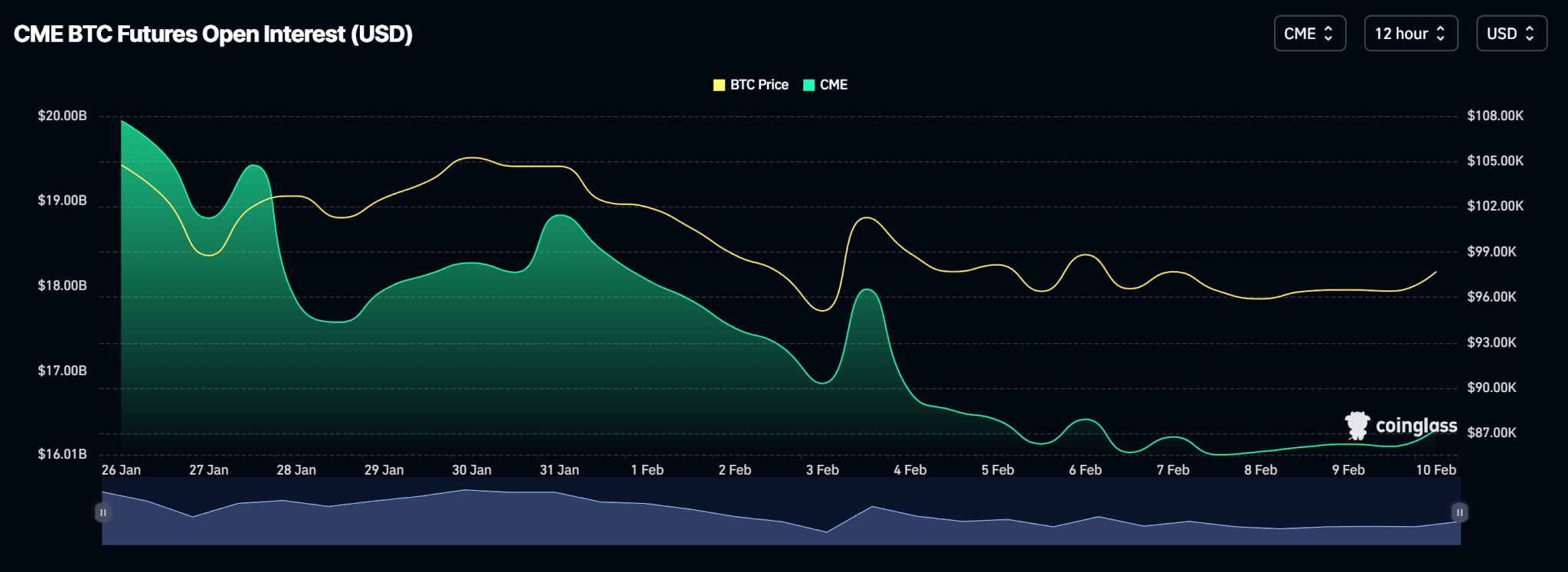

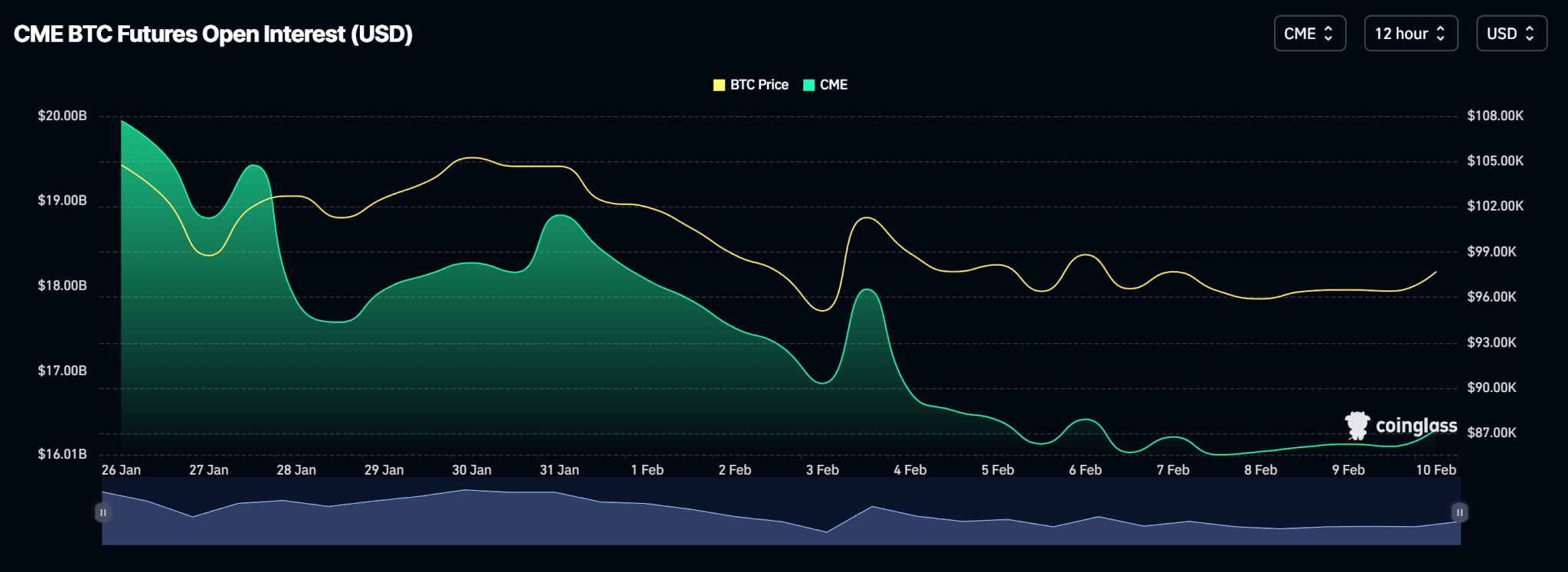

In CME, where Bitcoin futures are most traded, interest opened last week fell as traders closed contracts due to uncertainty caused by Trump’s tariffs.

Meanwhile, the Spot BTC ETF recorded a positive week as net flow printed $283 million despite a big two-day spill.

Price outlook

If prices remain above demand zones in daily time frames, the overall structure of Bitcoin should remain bullish despite the price drop in the substructure.

However, daily closures below the demand zone, i.e. the $90,000 level, can trigger a sale to support levels below the $84,000 level.

BTC traded at $97,624.73 at the time of publication.

Ethereum

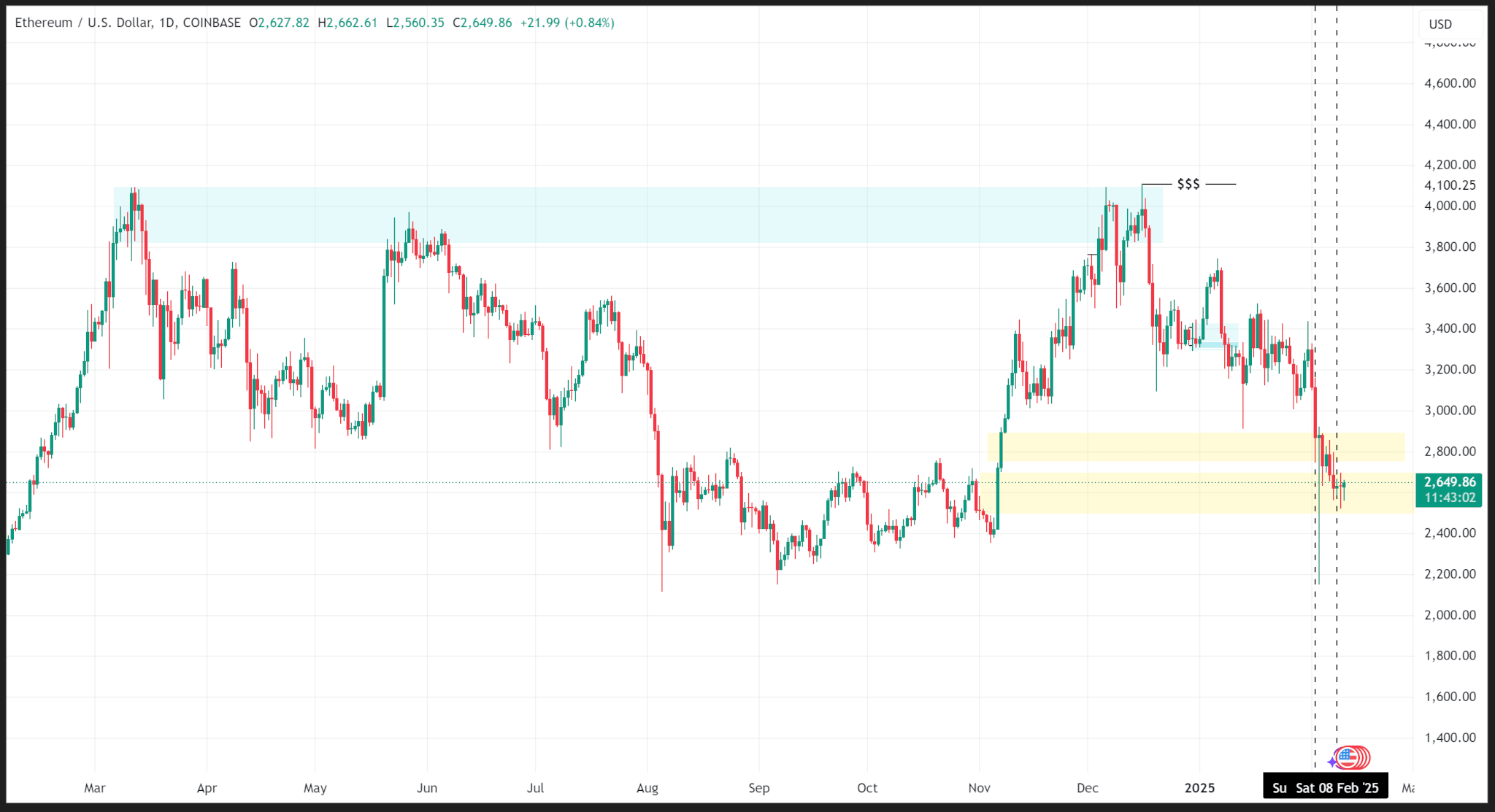

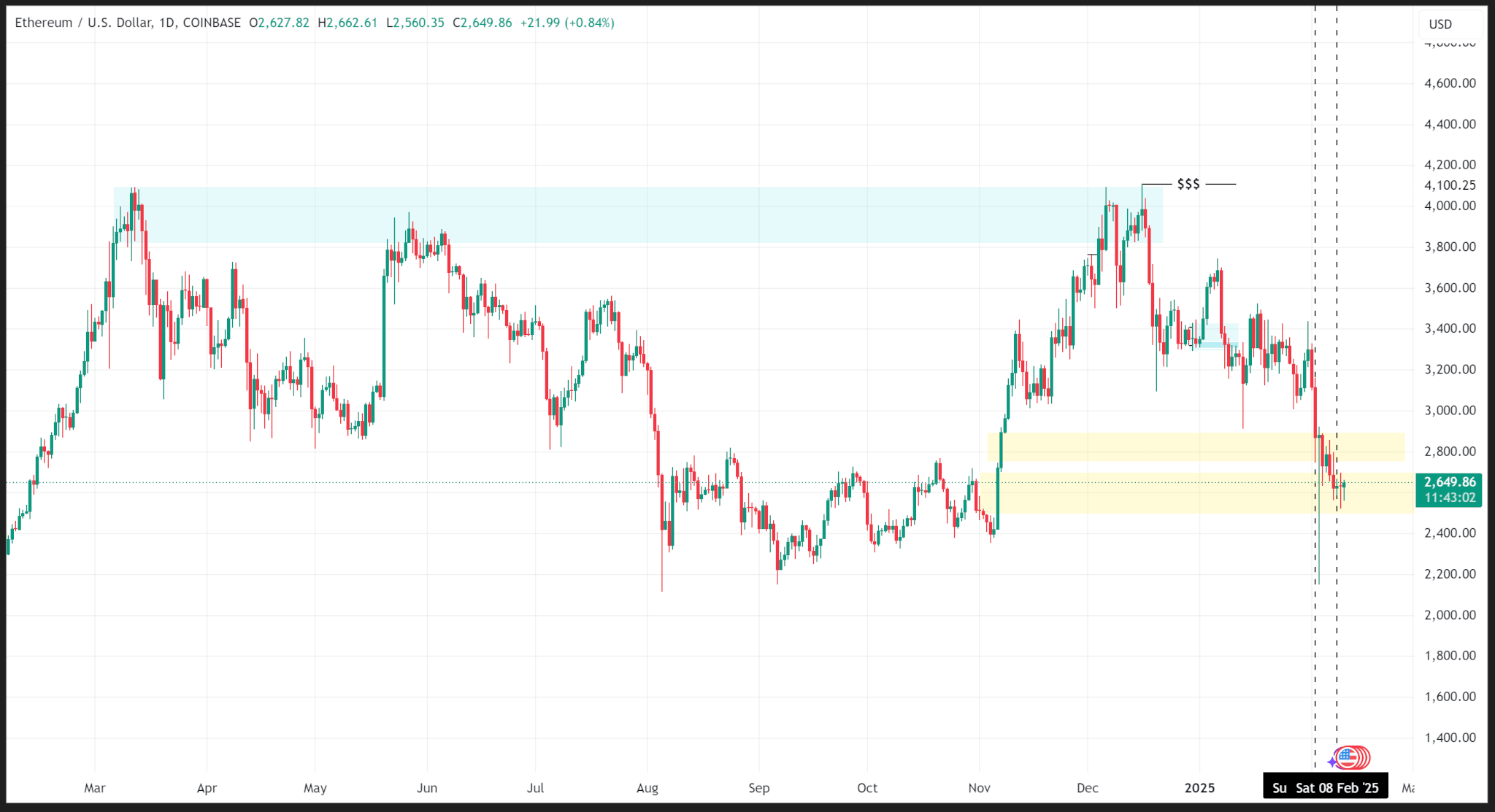

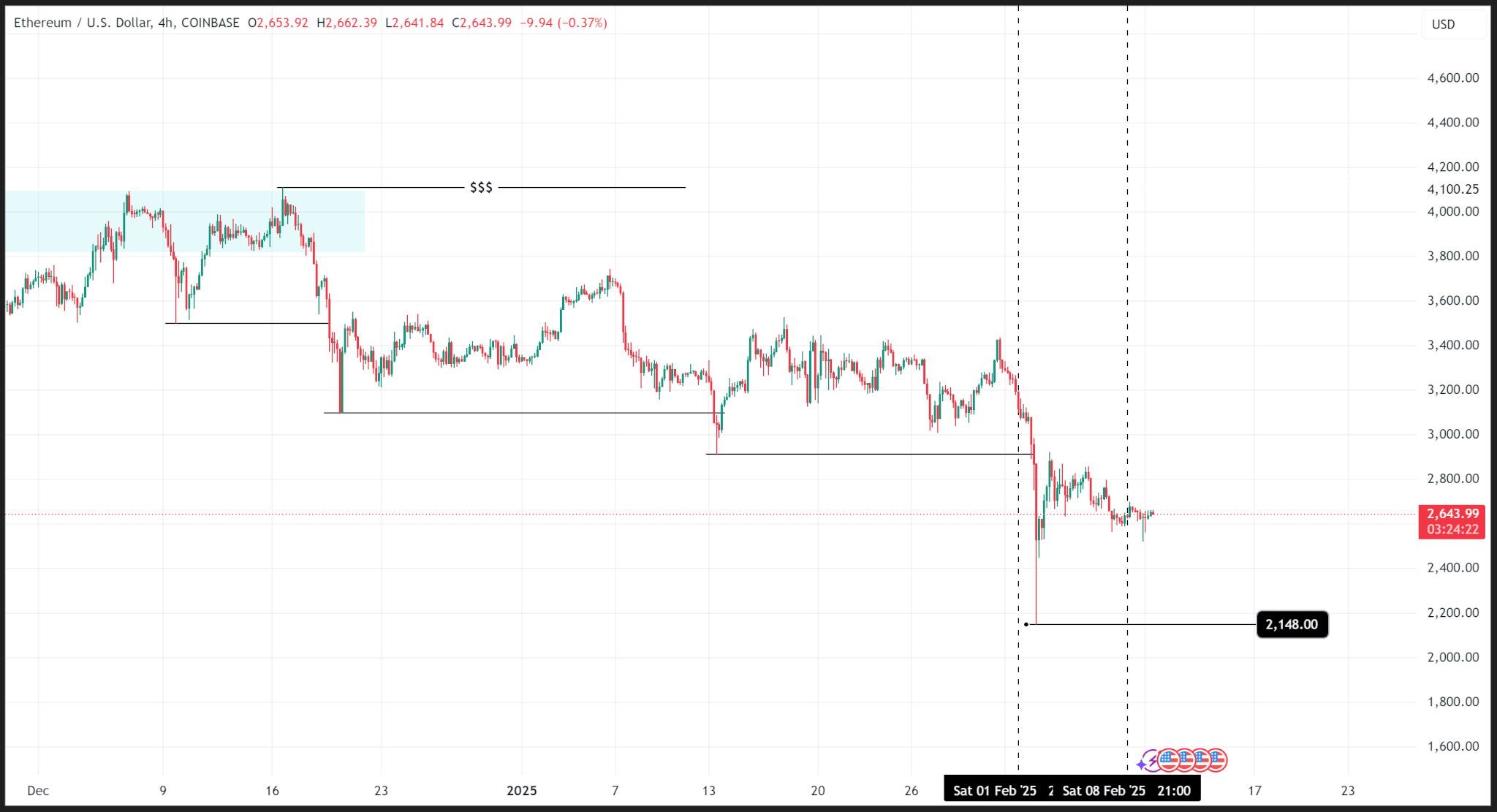

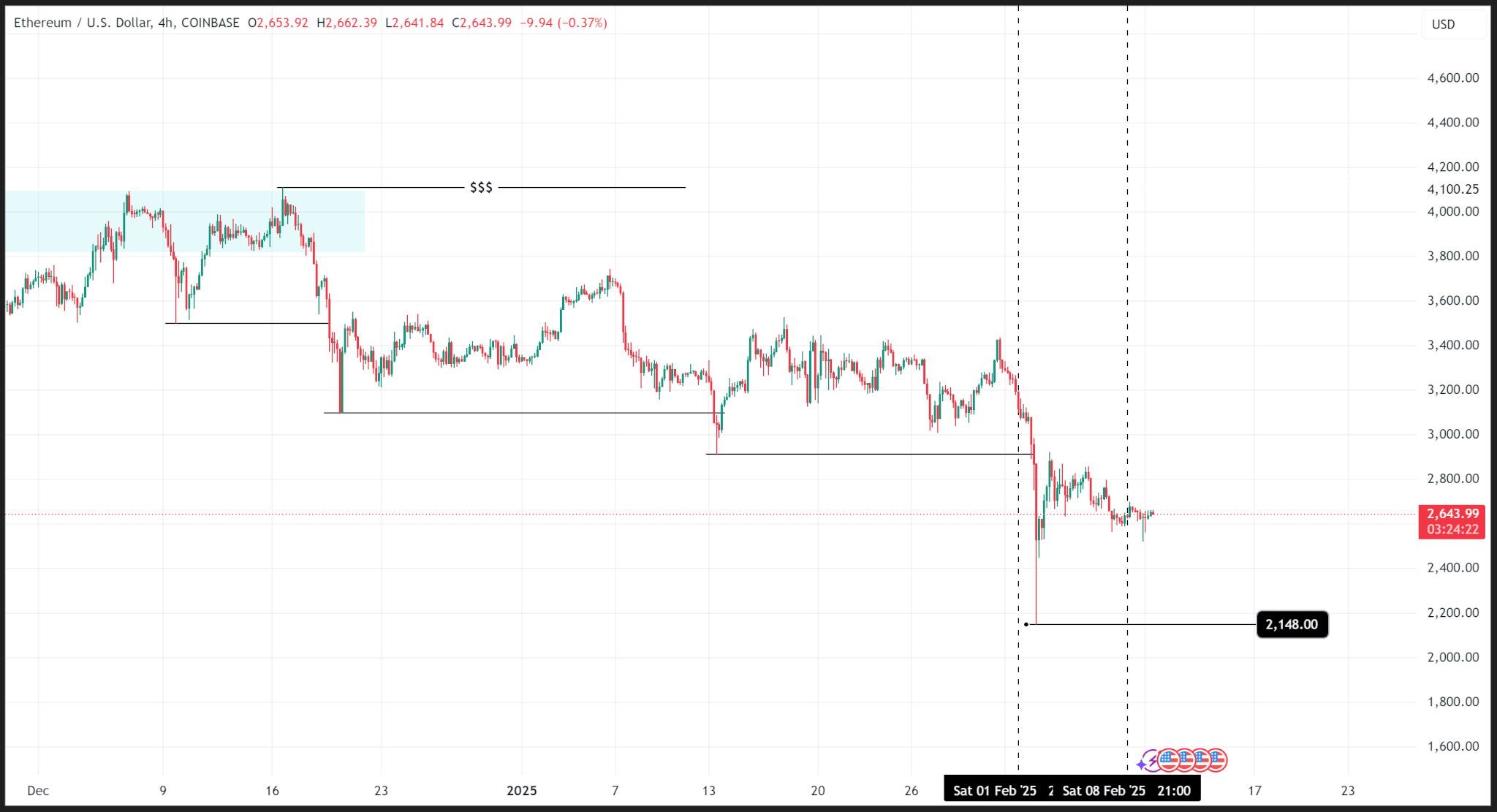

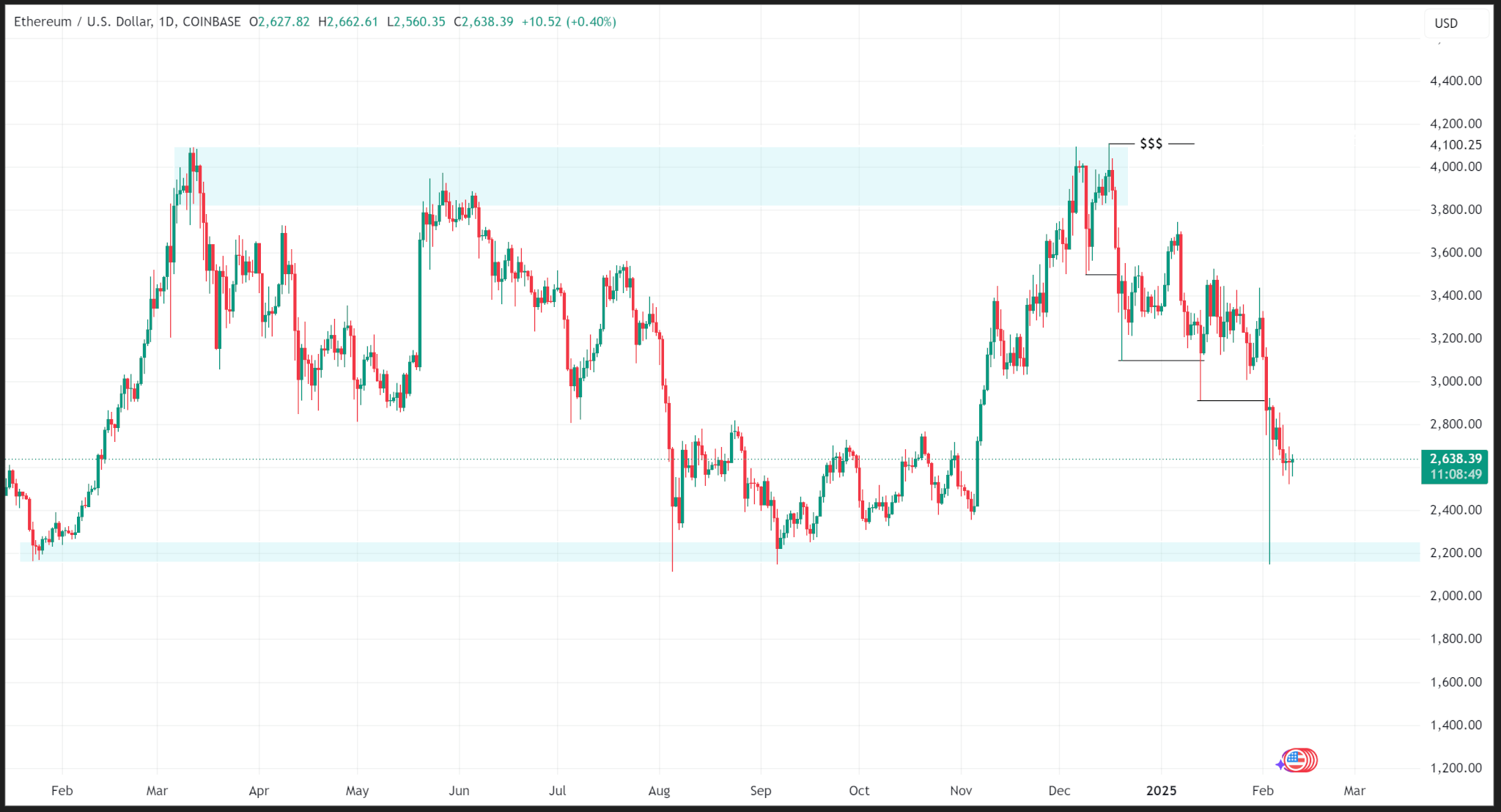

After exceeding the March 2024 high and not breaking, Ethereum prices have been in a downtrend understructure since mid-December 2024.

In the four-hour time frame, the price recorded a consecutive low, the latest low of $2,148.00, which reached the beginning of last week. Prices have since risen, closing at $2,632.16 last week.

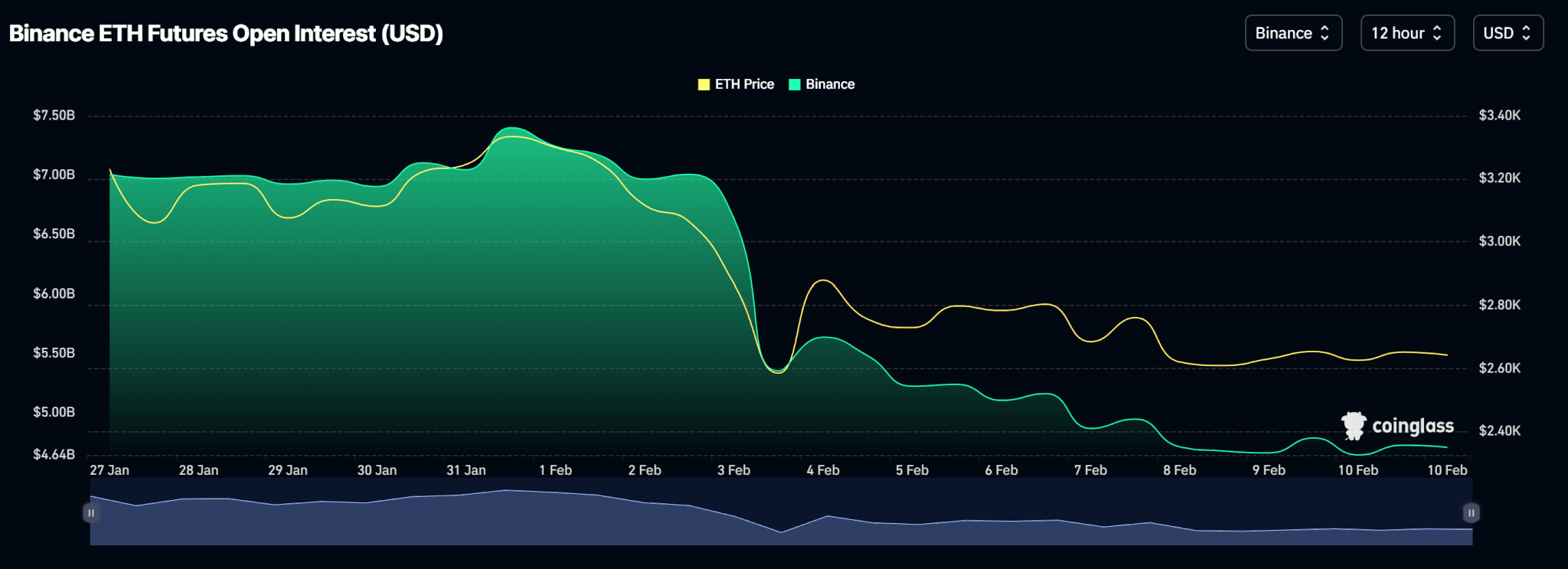

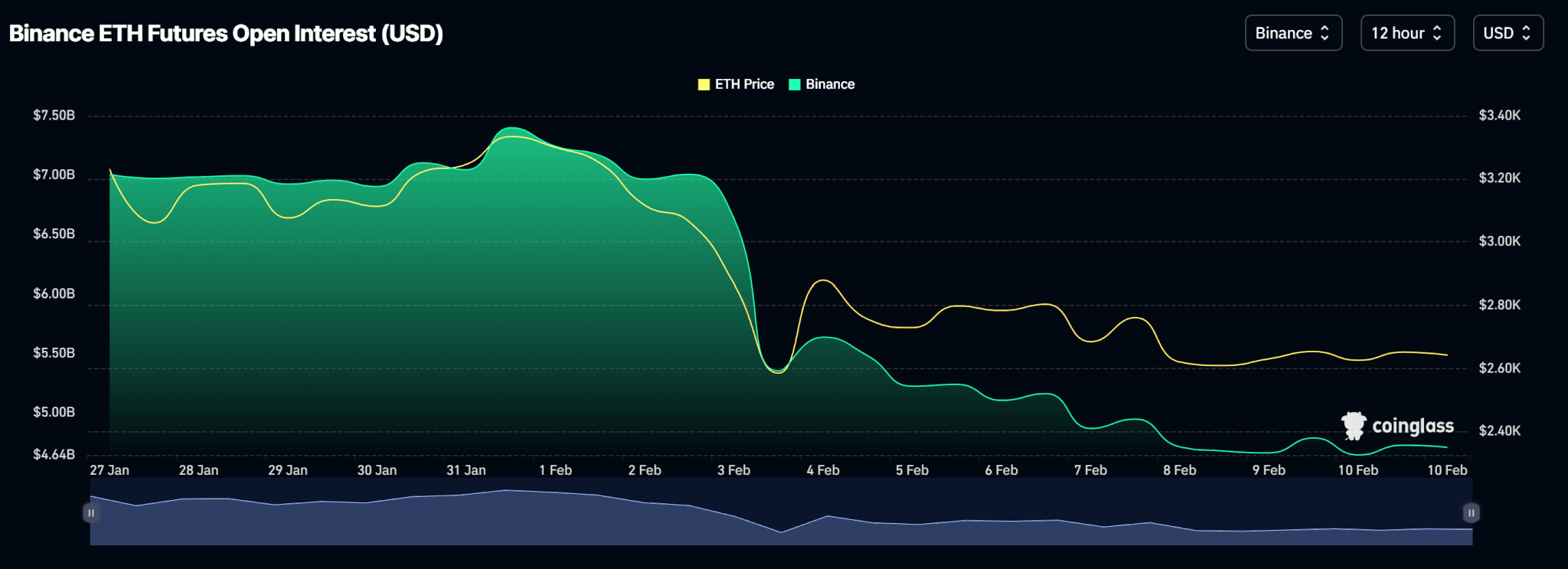

Open interest in the vinanence, where Ethereum futures are most traded, indicates a decline in the number of open contracts.

Meanwhile, the Spot ETH ETF recorded a positive influx last week, except for Friday, when Fridays did not inflow (or outflow), totaling $420 million a week.

Price outlook

The next possible zone for which ETH prices will drop is the main support zone, which is around $2,200. Trump is planning to impose a 25% tariff on steel and aluminum, as well as a new round of retaliatory tariffs on trade partners, which quickly puts more uncertainty on ETH prices It could push up.

ETH trades at $2,640.05 at the time of publication.